Inheritance tax planning and 2 solicitors' firms

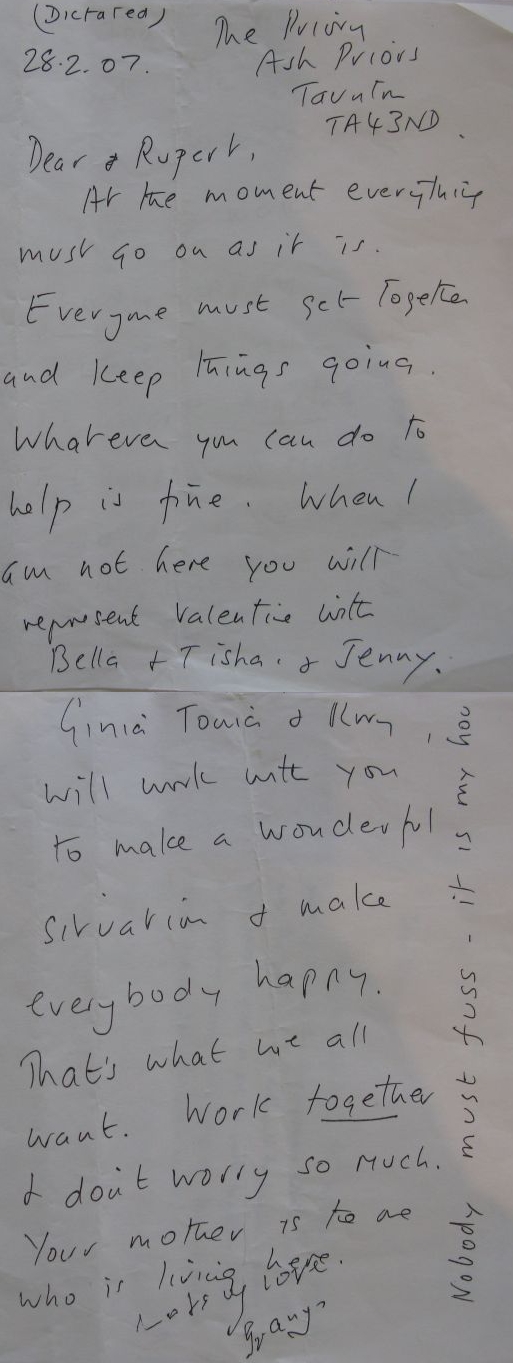

Discovery at trial reveals 2 solicitors' firms involved in making trusts, wills and a farm settlement in the 1990's. Bevirs solicitors and Penleys solicitors. Bevirs come up with a plan to defer inheritance tax from farm cottages let to tenants who aren't farm workers. The Bevirs plan spills over into the rest of the farm that benefits from agricultural relief to inheritance tax. It's all about 7 year gifts, spouse exemptions, nil rate bands, discretionary trusts, protective life interests, trusts and trustees. Agricultural work and workers (first of all my grandfather as a dairy farmer then my parents at Taunton Trees) get scant recognition in these plans. Bevirs say agricultural relief to inheritance tax isn't needed because of gifts and trusts.

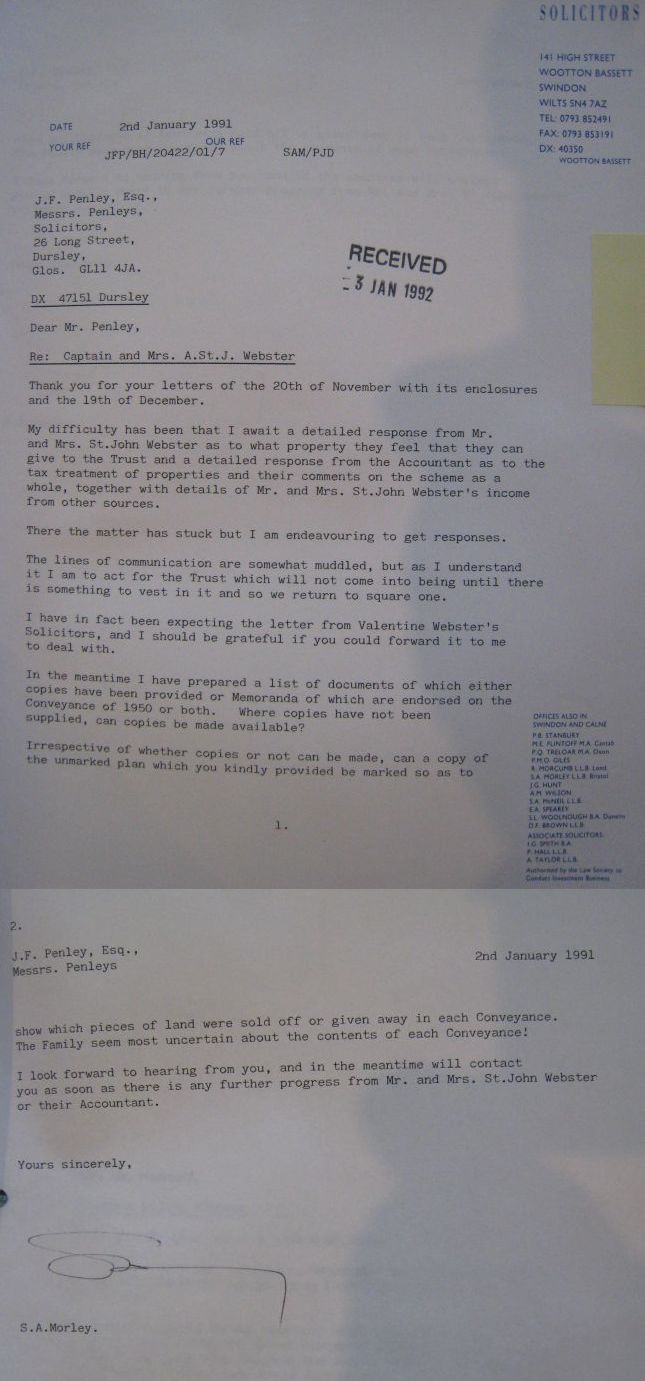

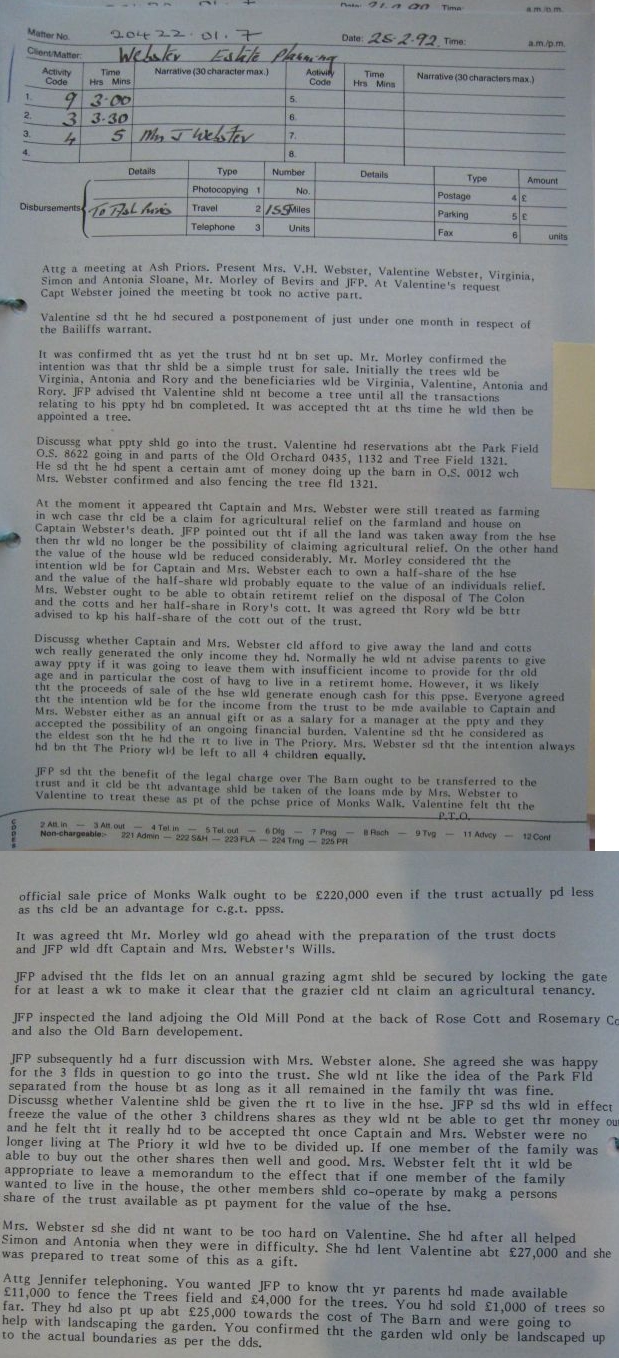

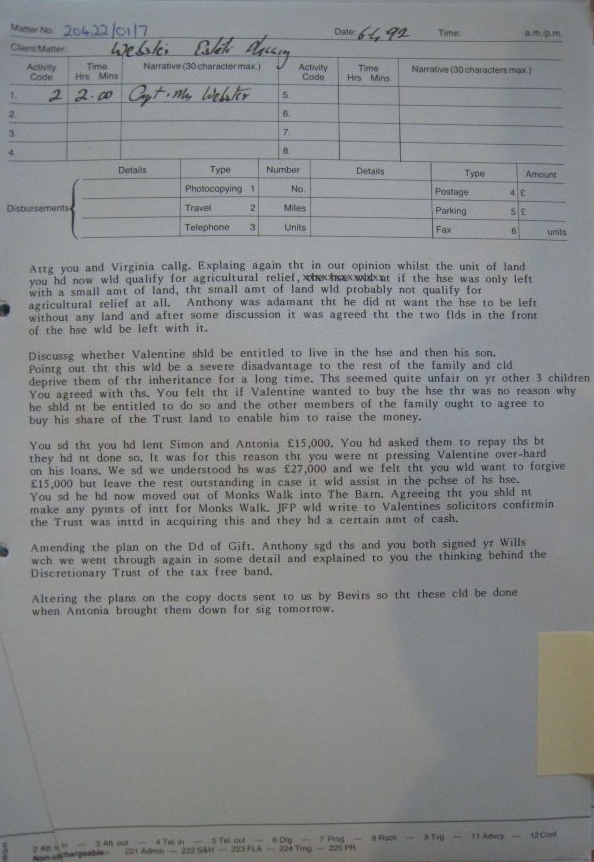

Grandmother's inheritance tax meeting

There's a meeting with grandmother to work out the details. Bevirs and Penleys solicitors attend. The latter acted for grandfather as freehold legal owner of his own farm, but he wasn't actually invited. By this time my Dad was actively working the land and rescuing farm buildings from dereliction. He finds out about a big solicitors meeting and attends, inviting his father "who takes no active part" in it. At one point my Dad says that he considers that he has a right to live in the farmhouse. Mother & grandmother says the whole estate shall be equally divided. After the meeting Bevirs are to prepare a deed of gift and a settlement for the farm and farm cottages, and advise Penleys on wills.

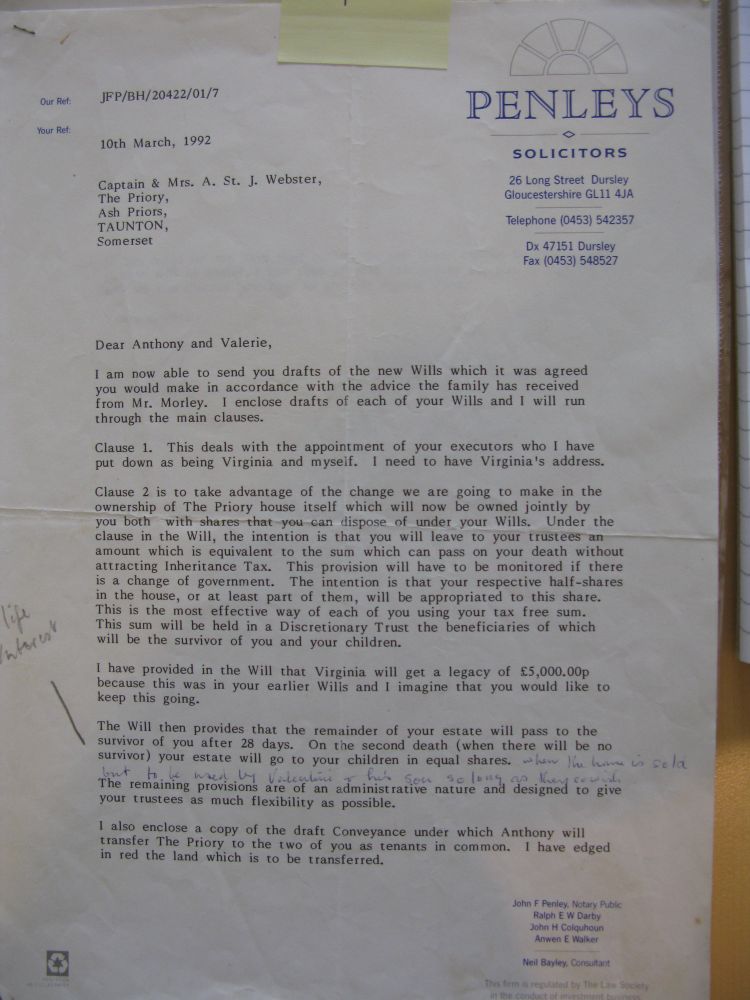

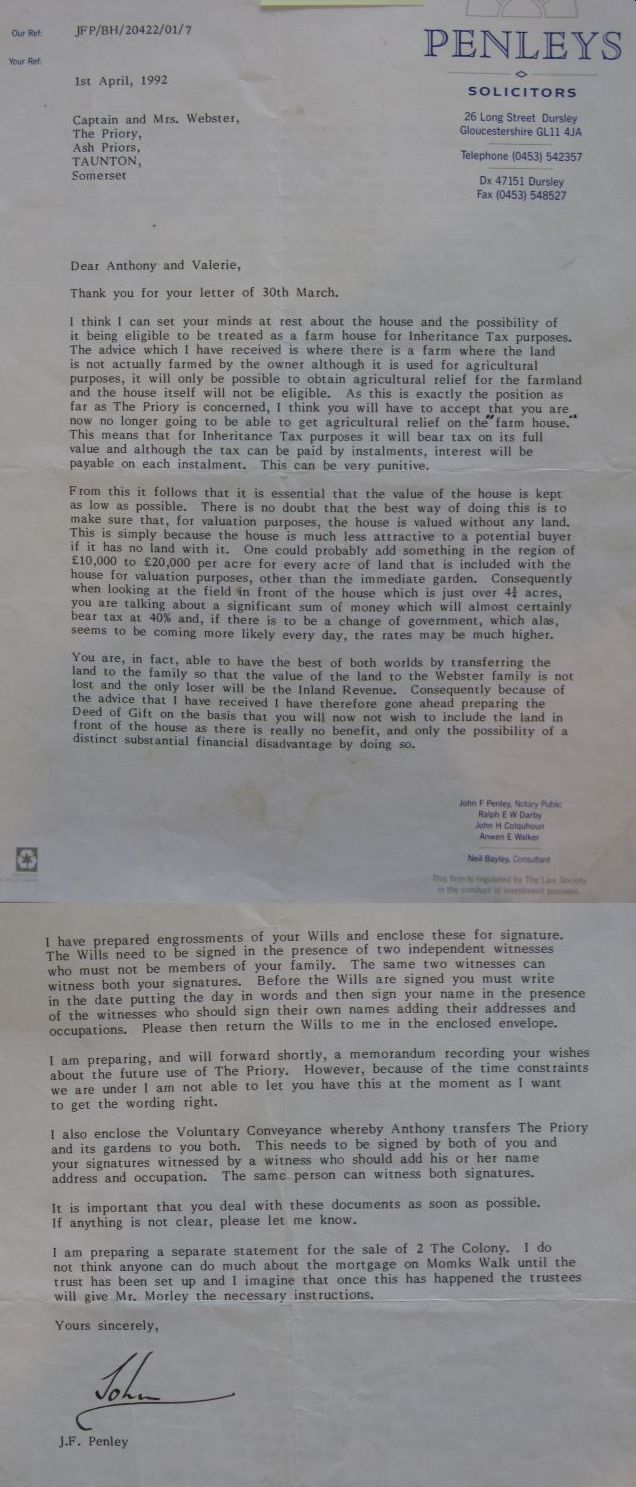

Wills

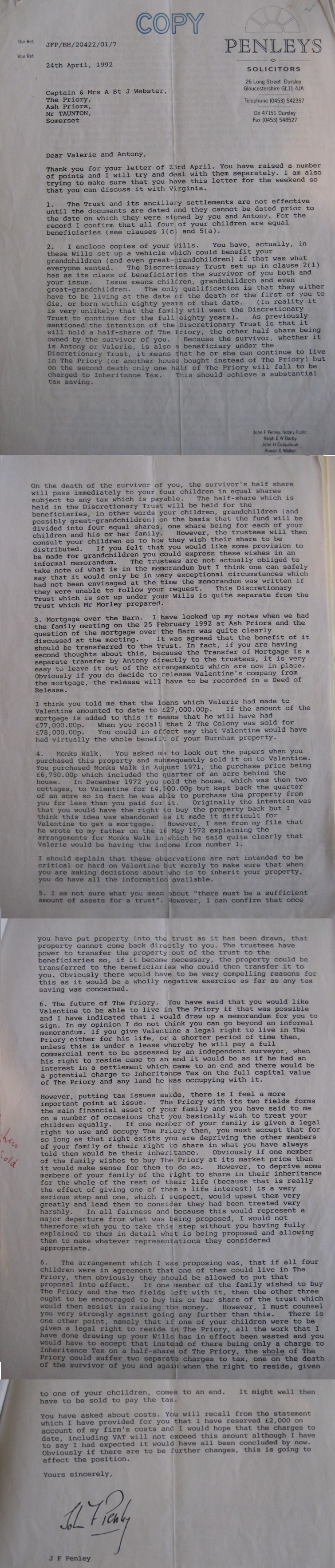

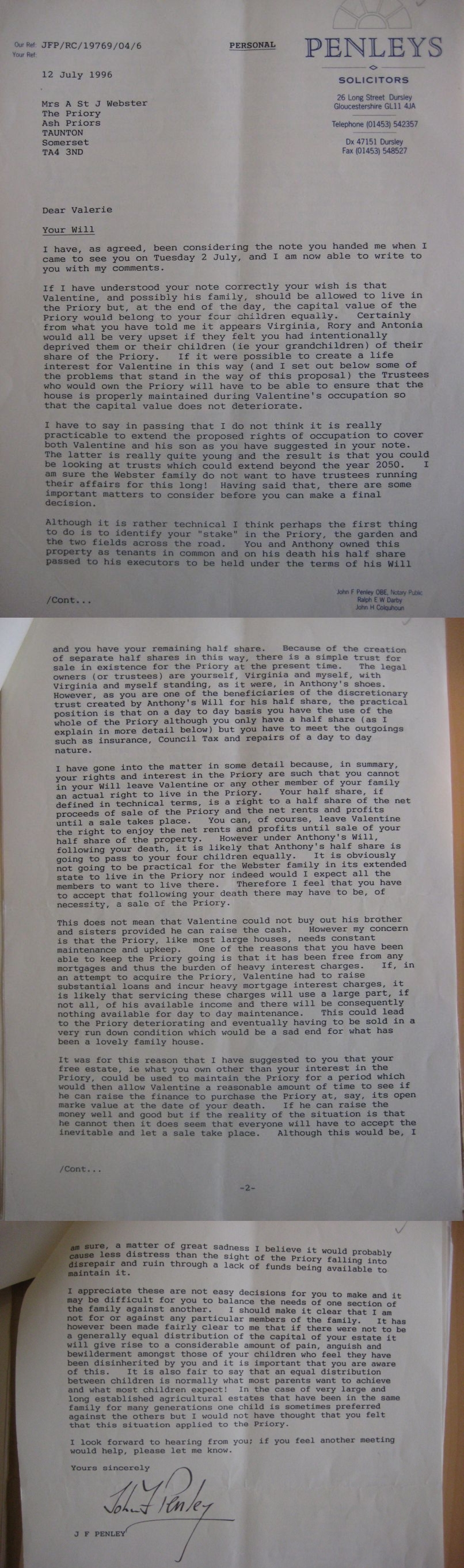

Regarding wills, a few days later there's letters and phone calls to Penleys instructing life interests in the farmhouse for my Dad and me. There's more discussion on agricultural relief to inheritance tax. Penleys prepare wills based only on the Bevirs plans taking no notice of their instructions for life interests. However, they say there can be "a memorandum" about the future use of the farmhouse, but "I can't let you have it now because I want to get the wording right".

Grandfather's meeting

On will signing day there's a meeting organised by Penleys. So the legal owner is actually invited. There's more instructions for life interests. Penleys dispute whether that's fair and the conclusion is a "buy out deal". On that basis the wills based on the Bevirs (and now Penleys) advice are signed. A few days later Penleys writes another letter saying that life interests cause tax liability and "the house may well have to be sold to pay the tax". Though they still say there can be a buy out deal. I checked with National Tax Helpline on 0300 200 3300 and life interests have no effect on estate valuations or on tax liabilities. If a life tenant is already resident in an estate that could reduce the valuation for inheritance tax. Penleys don't appear to like their clients using life interests.

Agricultural relief

Nobody is taking any notice of my grandparents' 40 years agricultural work, nor my parents (nor then me) at Taunton Trees and eligibility to agricultural relief.

Written instructions

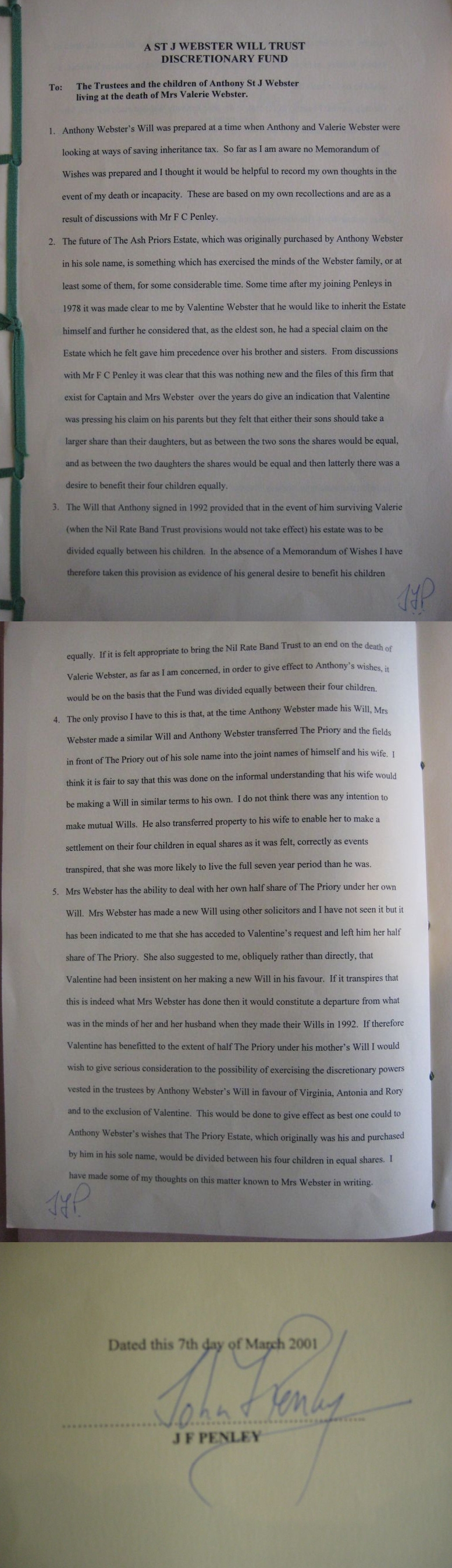

A discretionary trust doesn't say that professional trustees can't carry out instructions from their clients. The clients are repeatedly told there can be a deal. I think there's a duty for solicitors not to deceive (either intentionally or by having forgot) their clients.

Prior dispute

In any event after grandfather died his estate's valuation wasn't liable for inheritance tax. Otherwise there would have been a dispute when a tax liability was presented for the farmhouse without agricultural relief. The life interests, residential occupation in the farmhouse, invoices for agricultural works, and agricultural relief to inheritance tax would have been litigated many years before.

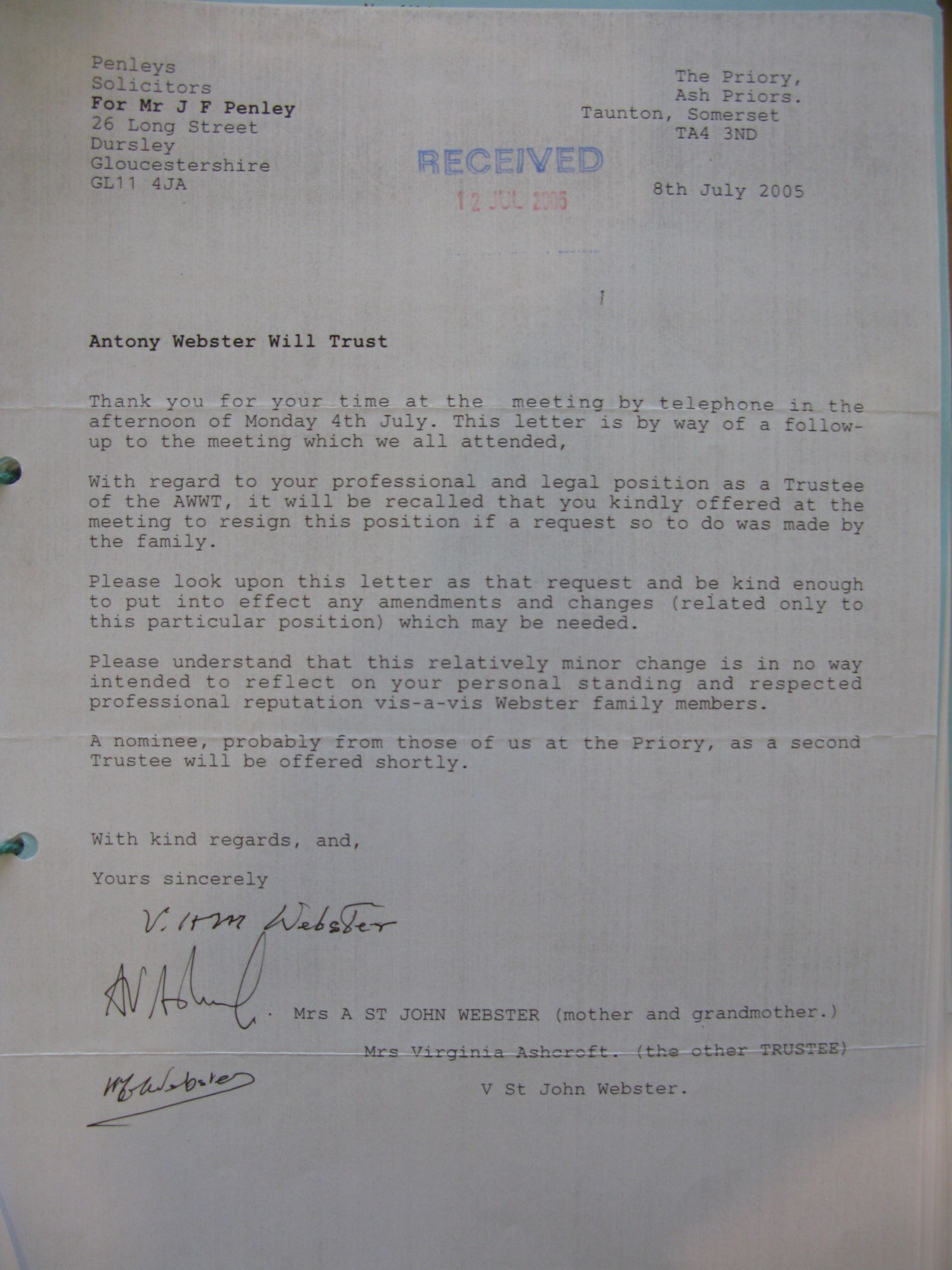

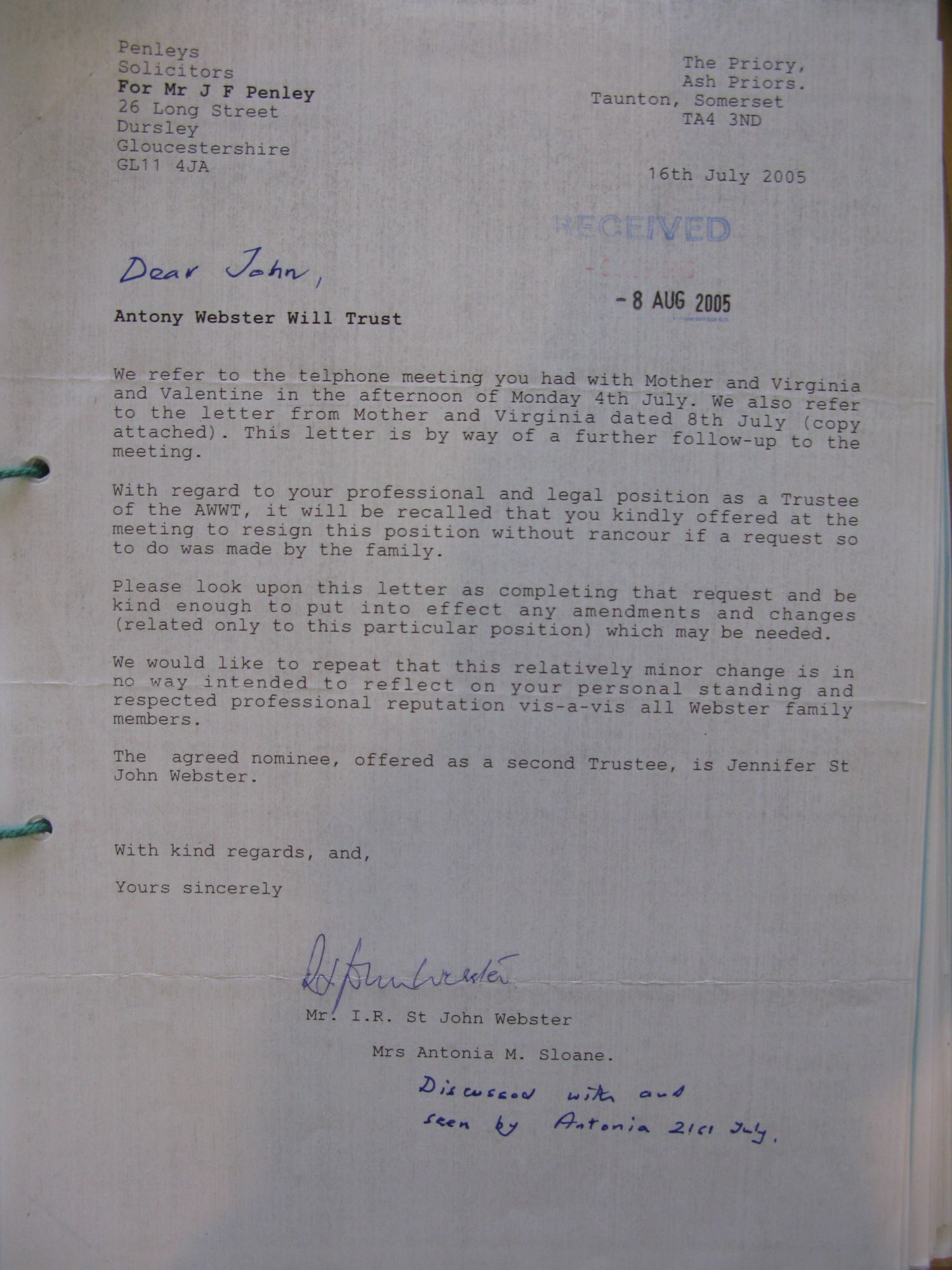

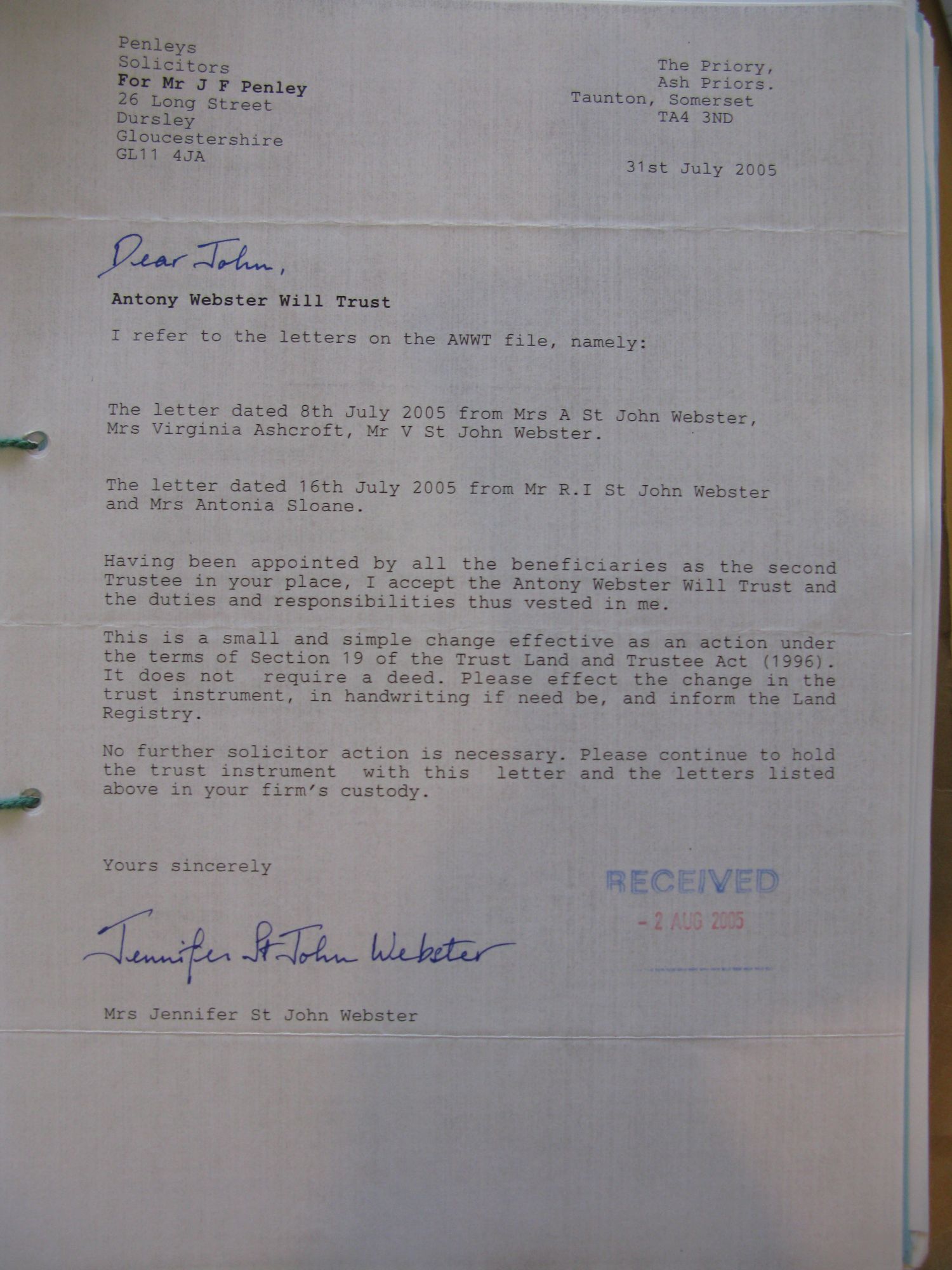

Penleys dismissed

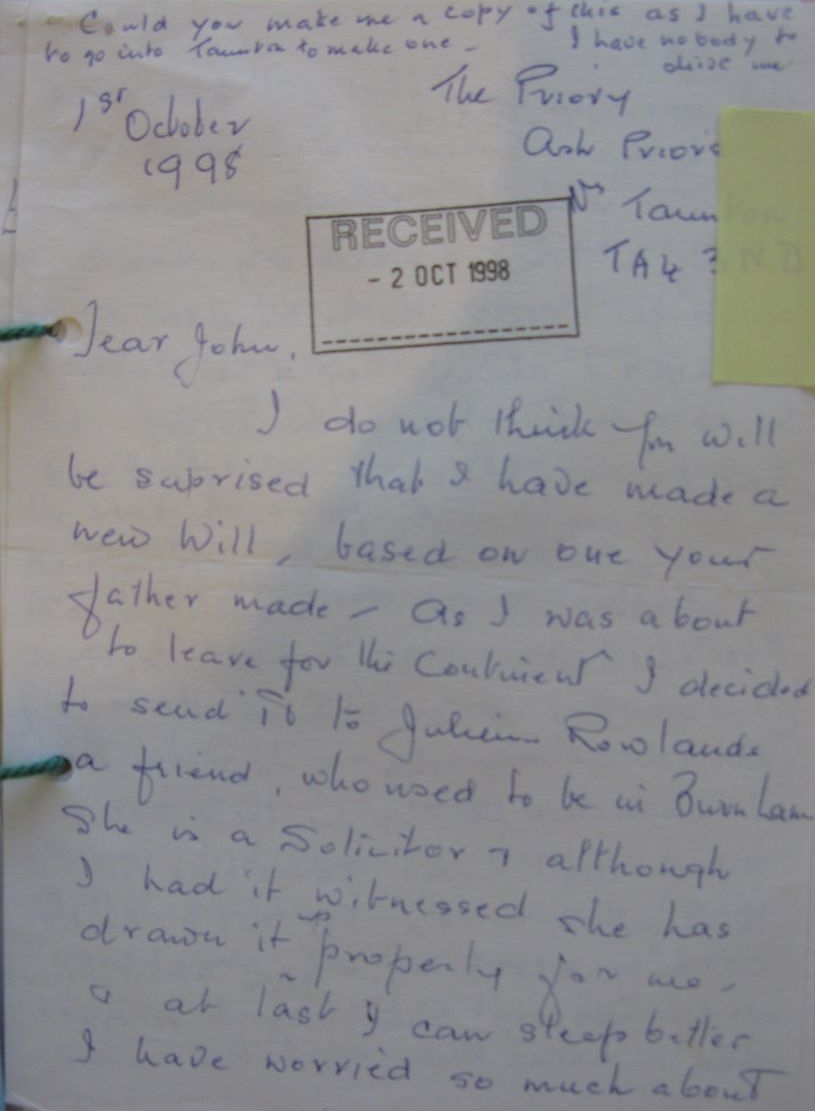

After my grandfather died my grandmother asked Penleys to implement the life interests. They refused saying "that's impossible". She dismissed them as solicitors and hired new ones. The remedy to implement the life interests is for my grandmother to write a new will and leave 100% of the farmhouse to my Dad instead.

Years of residency

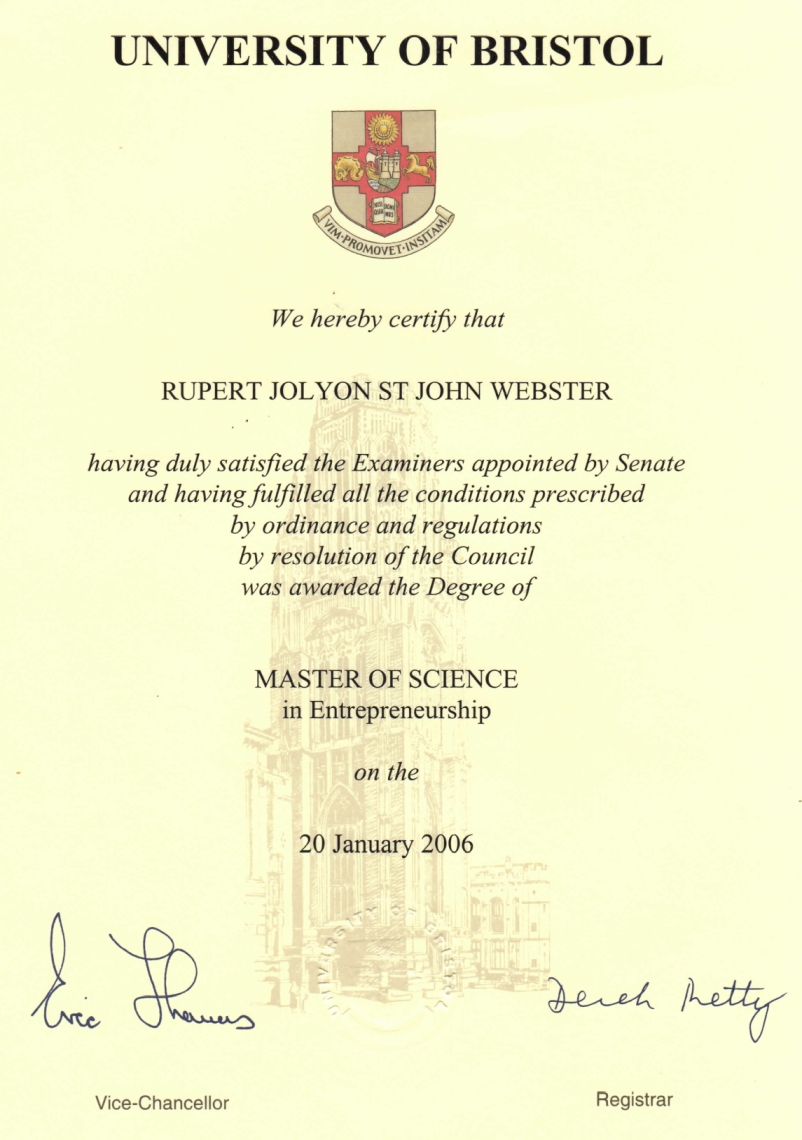

Nearly 10 years go by with my parents resident in exclusive quarters at the farmhouse and working at Taunton Trees. My Dad maintained the rest of the farm. It's full-time agricultural work. Meanwhile I was also led to expect to inherit the house and carry on the land. I sold my flat to invest sale proceeds into the farm starting a field of St John's Wort and doing a Masters degree in business. Even though agricultural work is unprofitable on a small scale, so I also carried on a career in software development.

Penleys memorandum

Penleys produce a memorandum that "to get the wording right" rejects any future use of the farmhouse at all. Where's "the house may well have to be sold to pay the tax" life interest issue?

MND and Penleys dismissal

1 thing that my Dad did as he suffered MND was get the whole family to ask Penleys to resign as trustees.

Back to introduction

That's about what's gone on before the introduction.

Who are the courts listening to?

Nobody is listening to grandfather (life interests and buy out) or grandmother (remove disability clause) or father (dismiss the trustees) or mother (after 43 years at Ash Priors I ought to have some interest) or me (no evictions thank you).

Remove disability clause

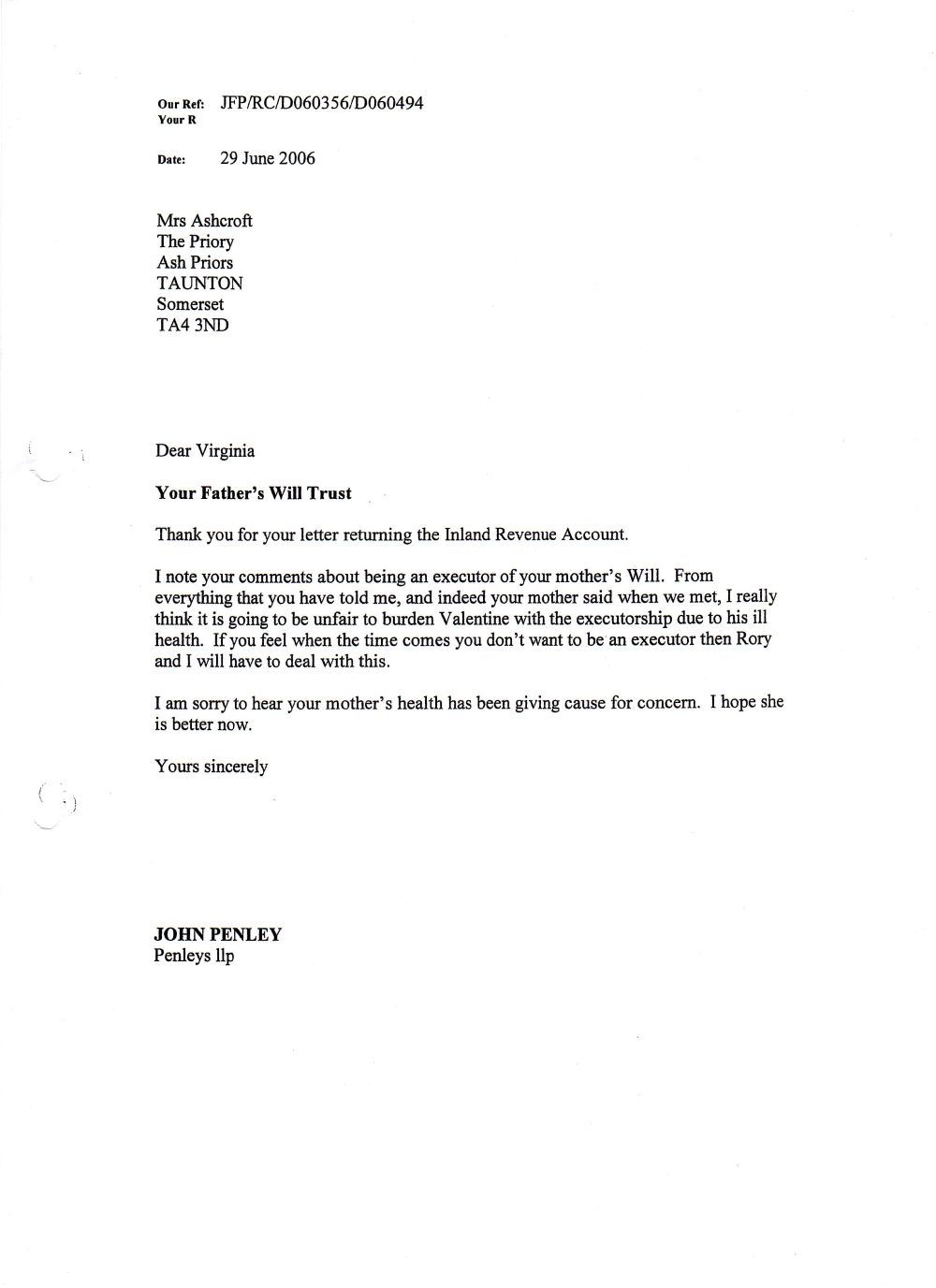

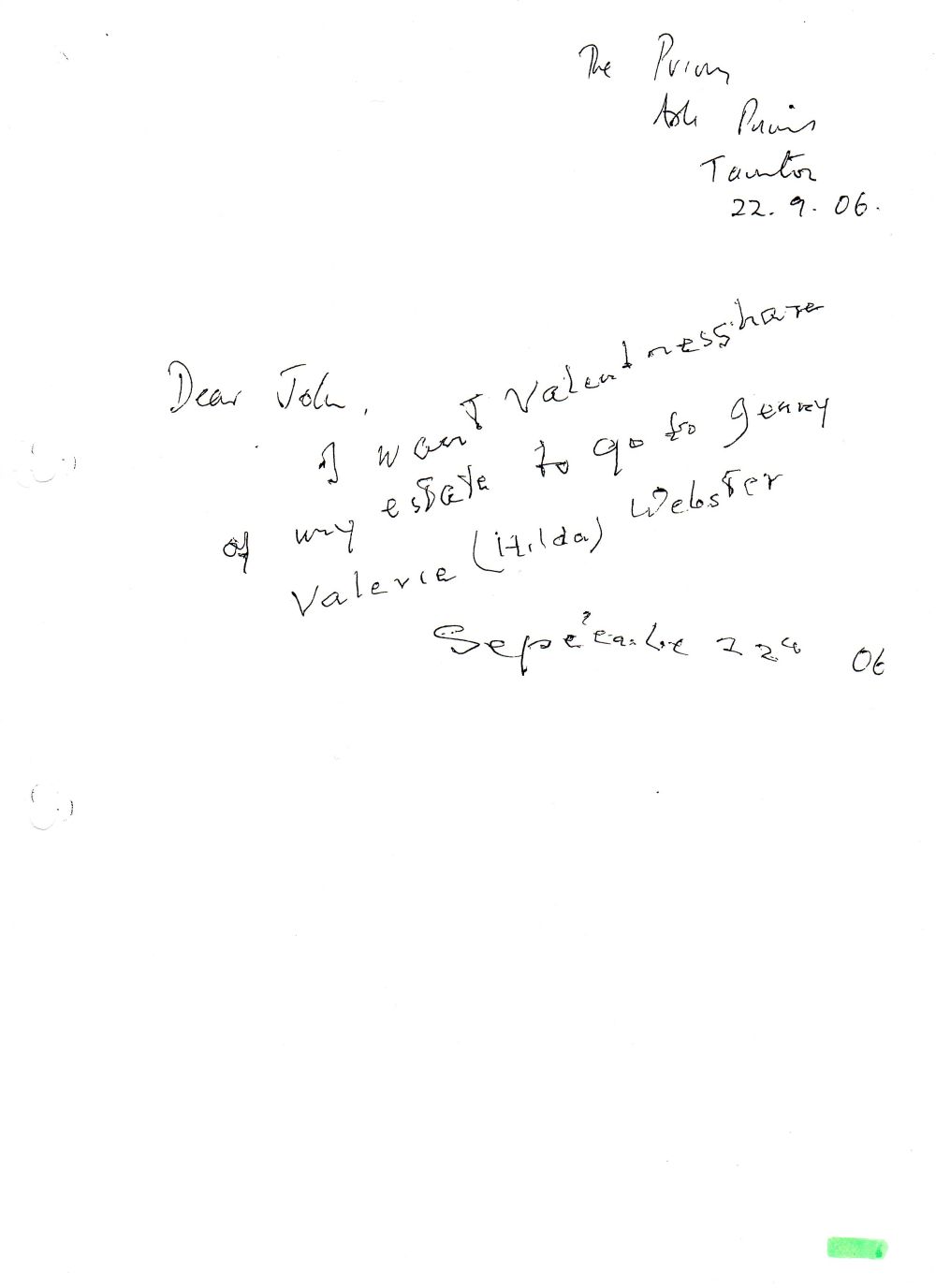

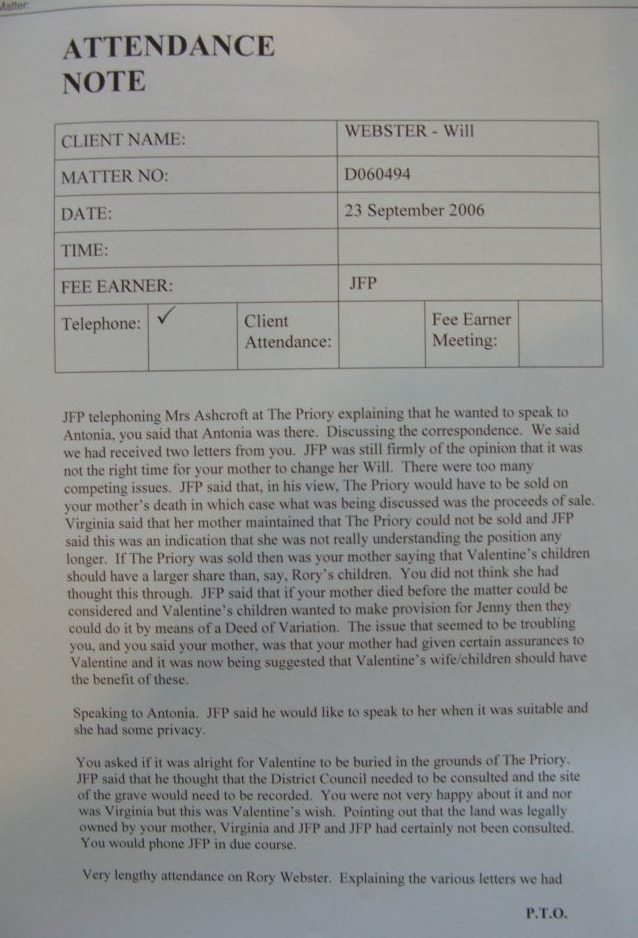

It's not until after my Dad dies of MND that his nearly 100 year old mother reveals a new will to his family. On a review she decided that the disability clause introduced by solicitors ought not to take effect. She signed a new will witnessed by 5 people, though only 1 witness outside family members "attested". It's difficult to find witnesses in a small village in the countryside. She also wrote to solicitors to ask that the disability clause was properly changed. They told her that she wasn't understanding the position. She was at death's door in and out of hospital every week and that's that. There's power of attorney in favour of my Dad and his sister that I'm told means nothing because it "wasn't registered".

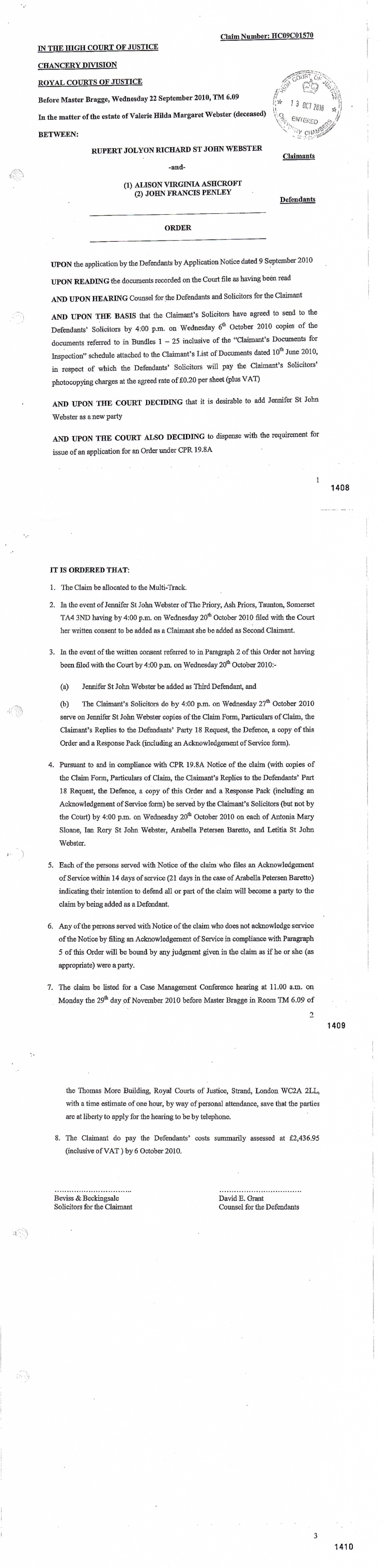

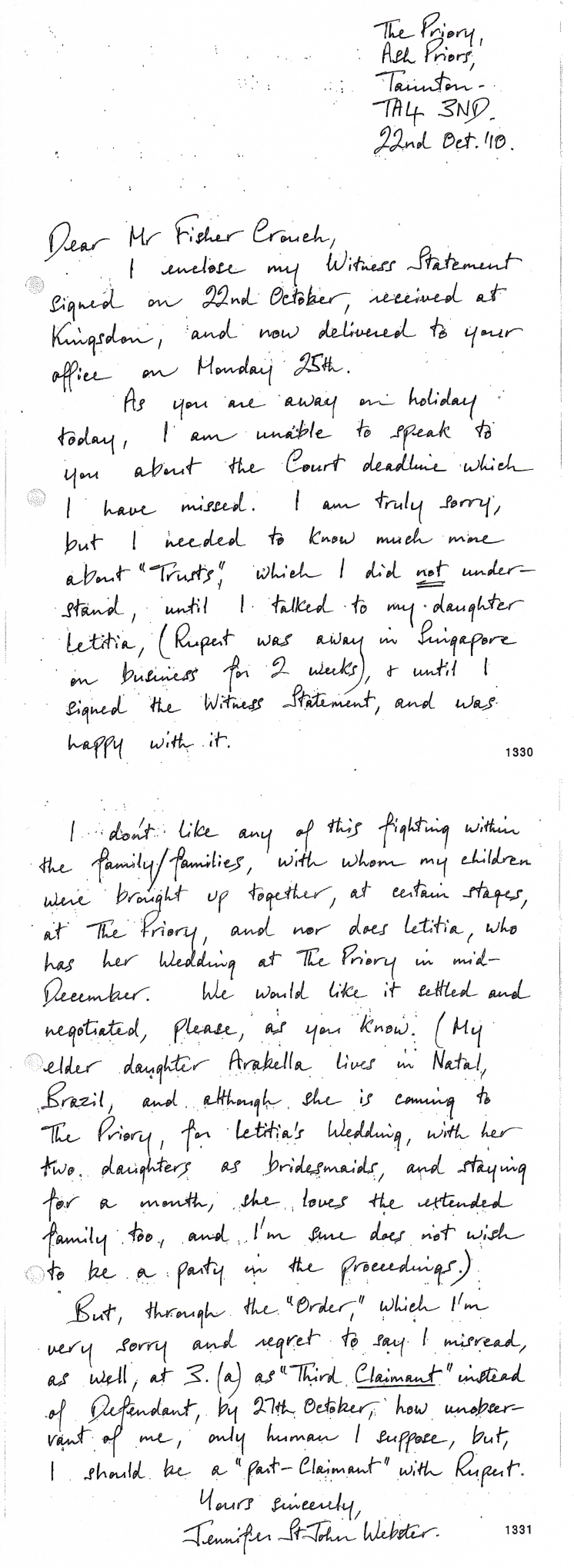

Litigation and widows

Once a claim was brought about a will another thing to happen was to join my widowed mother. She wanted matters settled without legal proceedings in courts. When the defendants made an application to join her it was resisted. The courts order her to be joined with £2,436.95 in costs against her. The order says that's payable by me. The order gives her 2 weeks to join as claimant or she's joined as defendant. This order sat in the court's office for 10 days. My mother takes legal advice and requests to be a claimant. Her letter arrives at solicitors a couple of days after the 2 weeks provided by the court's order that she hasn't seen until the day before. So she's made a defendant. What a mess. A central character with statutory benefit of a Housing Act assured agricultural occupancy either because of her own agricultural work or her late husband's full-time agricultural work now appears as a defendant disclaiming her own rights. My solicitors don't disclose her letter until the day of trial. I find it at the end of a bundle of thousands of documents going back to the 1950's. Who's the fool? The judge finds against her (that appears to be in her favour) and Tesco home legal insurers pay out almost a full £100,000 legal insurance fund to representing solicitors. 1 more thing. I've heard that my mother receives financial help from the farm estate. Though I can't prove that because, on a basis of my Dad's disability, his family members have no official legal role. Isn't there some torturous circular argument going on? For which my beneficiaries and I are ordered to pay solicitors £1/2 million in costs. Then I'm arrested by police and thrown out of our house without a trial. Against that I allege the state is guilty of an offence under Protection from Eviction Act 1977.

Burial ground

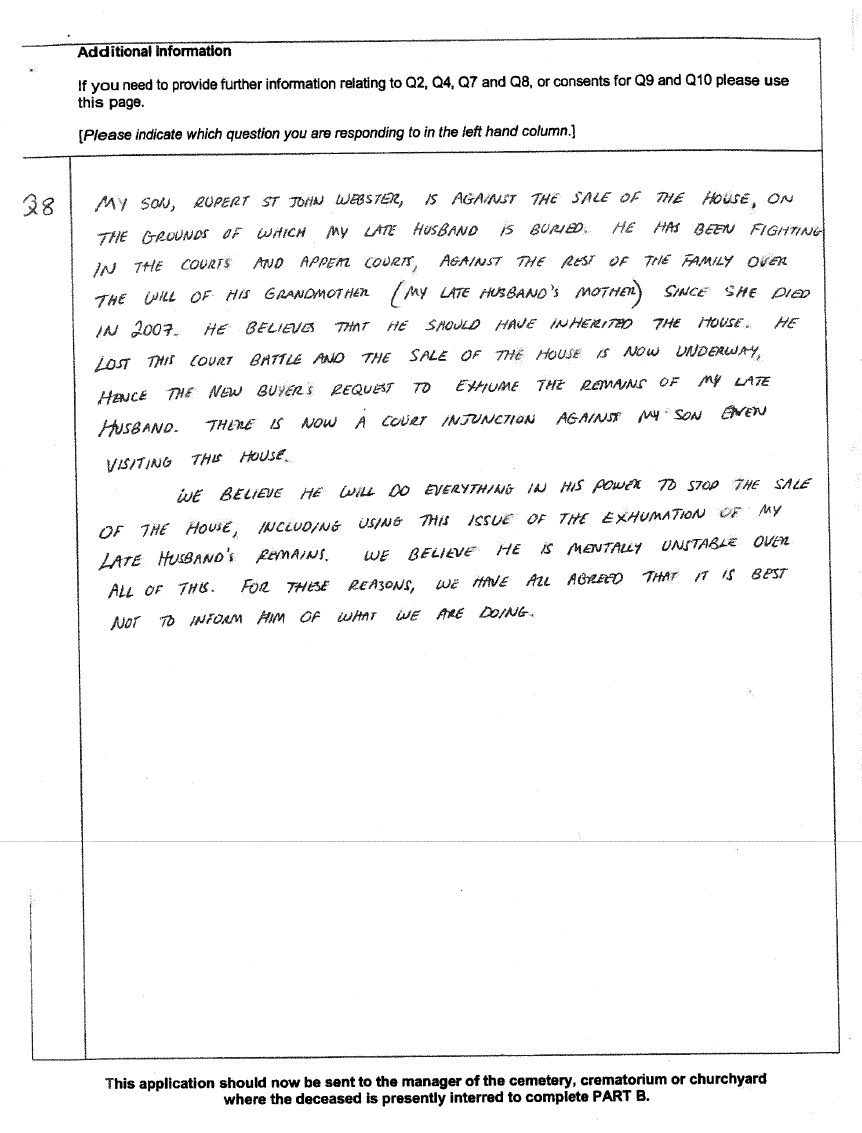

After my Dad died of MND he was buried in the grounds of his house as provided in his will. He grew up there, and since joining the Royal Navy as an officer cadet was encouraged by his father to expect to own the place and some land. After his career with the Navy he worked at the farm until he died there in 2006. It's not understood what causes MND. His parents were living well into their 80's and 90's. He asked to be buried there. The priest sanctified the ground. About 10 years later and his family's wrongful evictions (as above) and new representatives find buyers for the family home. Savills estate agents tell me that "the buyers are aware of the situation". I think it's a condition of sale that burial grounds shall be exhumed. As that's something that his executor is unlikely to agree not least without either very substantial compensation or negotations about who and how is the £1/2 million in costs going to be paid to solicitors, a form is sent to the Home Office alleging that I am a person with an unsound mind therefore should not be informed. Several different GP's haven't found me of unsound mind. However, I understand that's enough to exhume a burial ground. Do you know what Shakespeare says about his grave? There's nothing I can do without being told that any such matter is issue estopped and an abuse of the process of the courts with further costs.

Grandfather nullified

After all the inheritance tax planning in the 1990's with 2 sets of solicitors firms making wills, trusts and a settlement, and 1 solicitors firm playing off against another, the legal owner's instructions for his own property and family members are completely ignored. There's a whole lifetime of farming, handing that down to at least 1 son, no agricultural relief is applied. His agricultural business is being reduced to nothing.

Father nullified

My grandmother told me that "you shall represent" my Dad. That's impossible since he's dismissed as an executor on a basis of disability. The family is simply told there's no legal standing, and nobody had a job, business, home, nor did any work. You can't tell the state anything. They're listening to solicitors for a person with an unsound mind who failed to bring a claim for possession in a single trial. Until family members are restored to possession of their own quarters and land then a person with a disability and their family members are nullified on a basis of disability.

My contributions nullified

It's very hard work to make a living out of a small amount of agricultural land. A good idea, I thought, besides Taunton Trees, livestock and wildfowl, was St John's Wort, a best selling medicinal herb. As I was also encouraged to expect to carry on some of the farm, I sold my own property to move there, took a Masters degree in building small business, and planted an acre of St John's Wort. As soon as MND and then legal problems developed, my field of medicinal herbs was ploughed up without asking me.

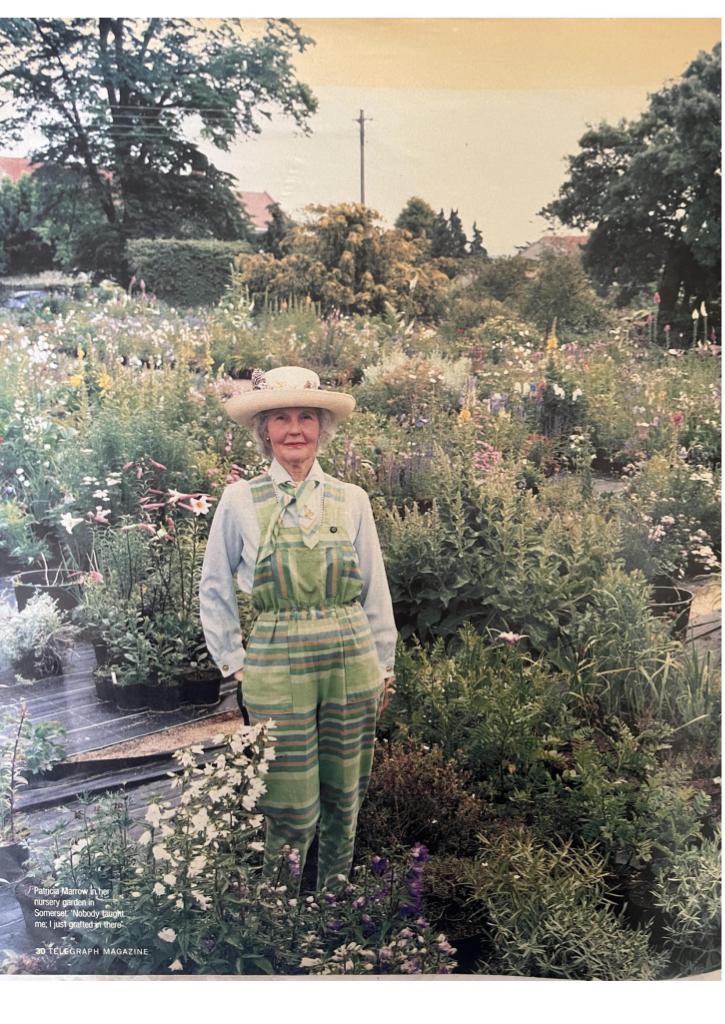

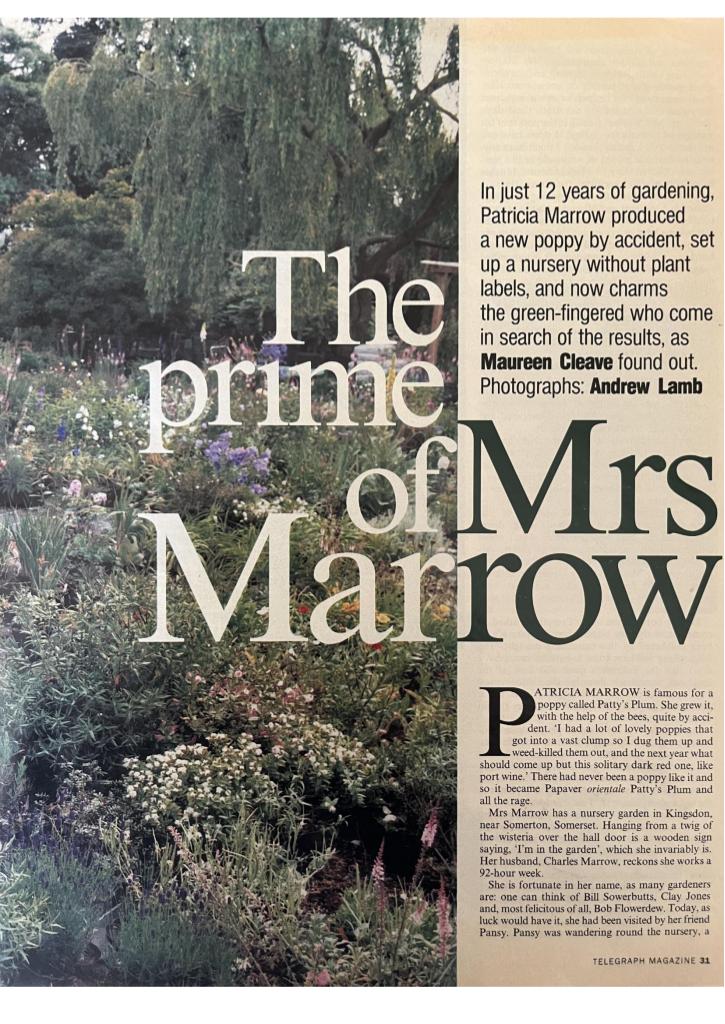

Maternal grandmother's garden nullified

My other grandparents were also farmers in Somerset. My grandfather ran a 350 acre agricultural holding. Alongside my grandmother who ran a market garden since the 1960's starting with orchids. Over the years her garden and work ethic were celebrated by national press, Gardeners World, and others. She first cultivated the poppy called Patty's Plum. When she became very elderly she suffered from dementia. So my mother "half moved" to her house to look after her. Without her celebrated garden then she ought to have moved to Taunton Trees the other way around. Instead, her house and her dementia were used to remove my family from our quarters. On 23 March 2015 I was told by the High Court in Bristol that rooms at my grandmother's house were available for my family.

Change the locks and nail shut the doors

I could not return home because the doors were nailed shut. Our household goods were removed to grandmother's house.

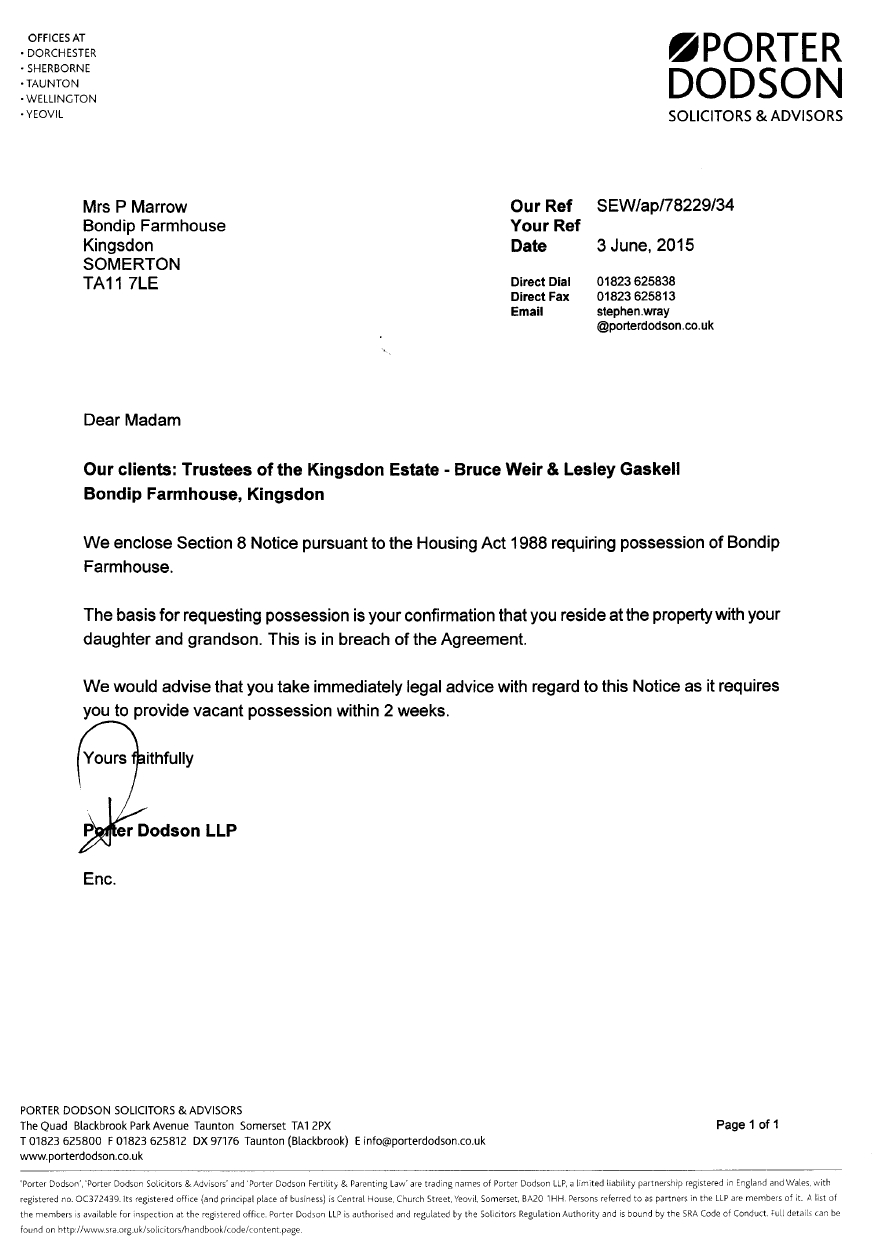

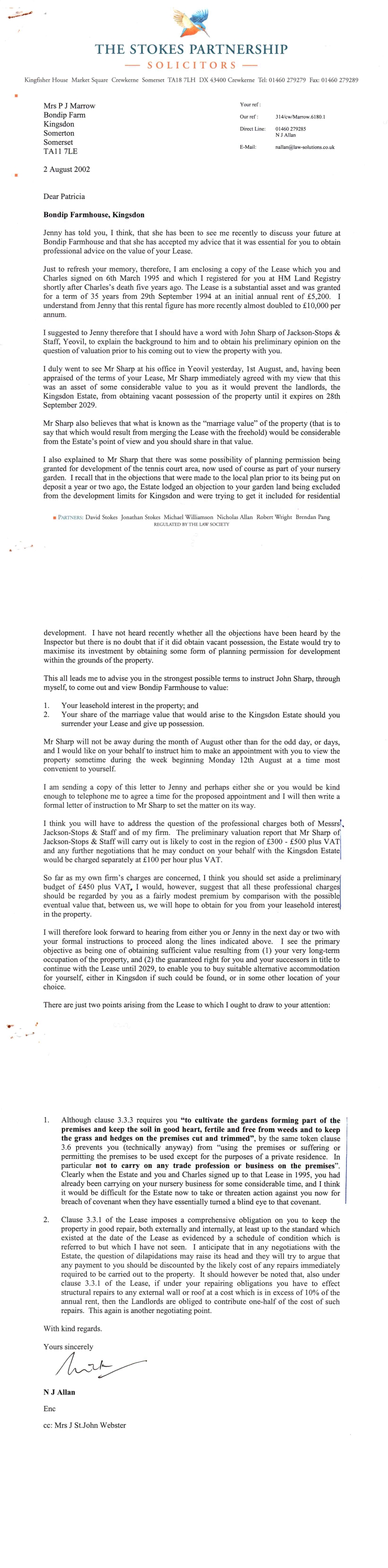

Now take 90 year old grandmother to court

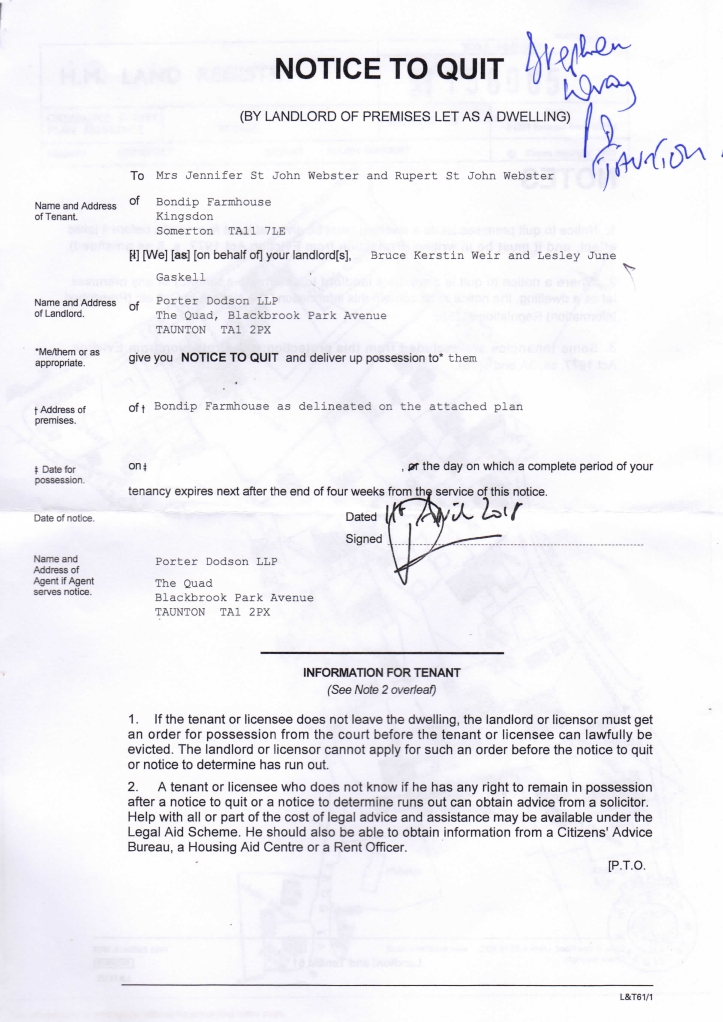

Grandmother's landlords since the year 1948 immediately issue a notice to quit her premises and her garden. However, given such a long tenancy and distant family relationship, and presumably her garden, they don't act on the notice. Look, everyone from both houses ought to have been joined into a single trial, which by now isn’t lawful without permission to appeal.

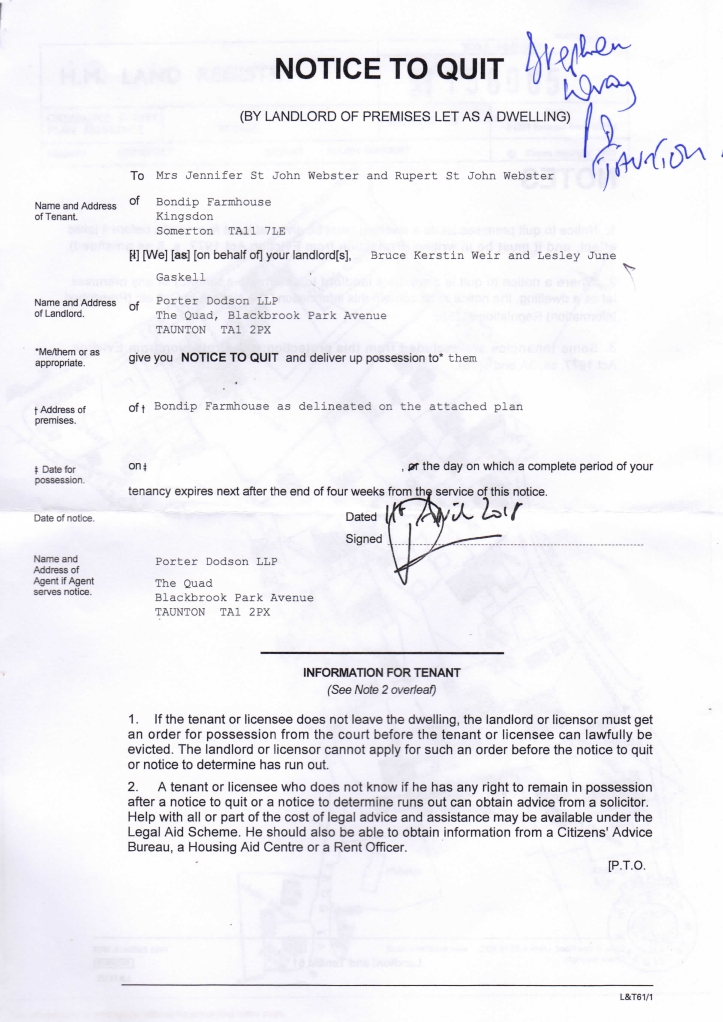

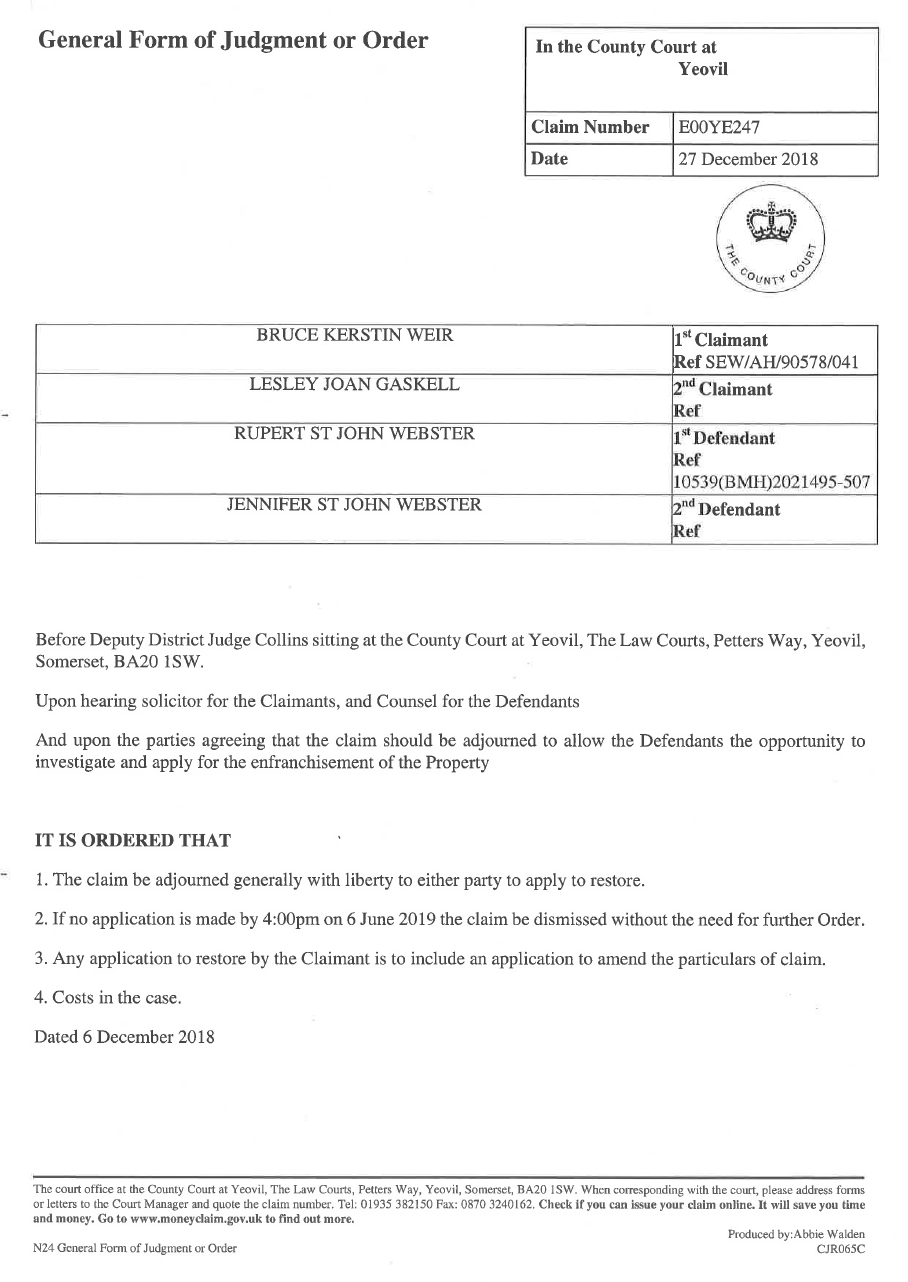

Another possession claim

After grandmother died nearly 3 years later another notice to quit is served. I understand that my mother made a deal to move out. Grandmother's landlords then brought proceedings against alleged trespassers. That's rude. The rents were still being paid as they had been since the year 1948. Once again for full-time agricultural workers under Schedule 3 Housing Act 1988 for full-time agricultural work with a relevant license or tenancy in qualifying ownership then 1 member of her family is entitled to her assured agricultural occupancy. There's also longstanding legal advice on leasehold enfranchisement. My home legal insurers provided another £100,000 insurance fund for a defence. On 6 December 2018 the landlord's possession claim was stayed by Yeovil County Court then dismissed 6 months later.

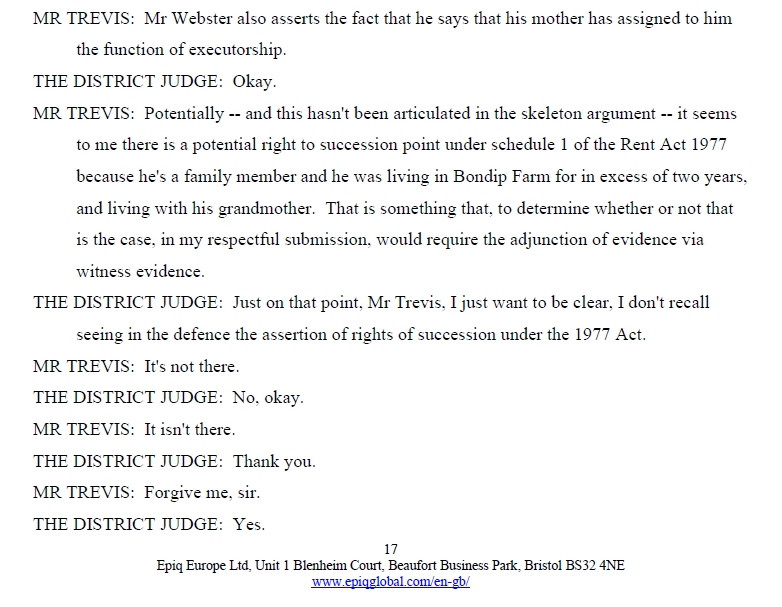

Yet another possession claim

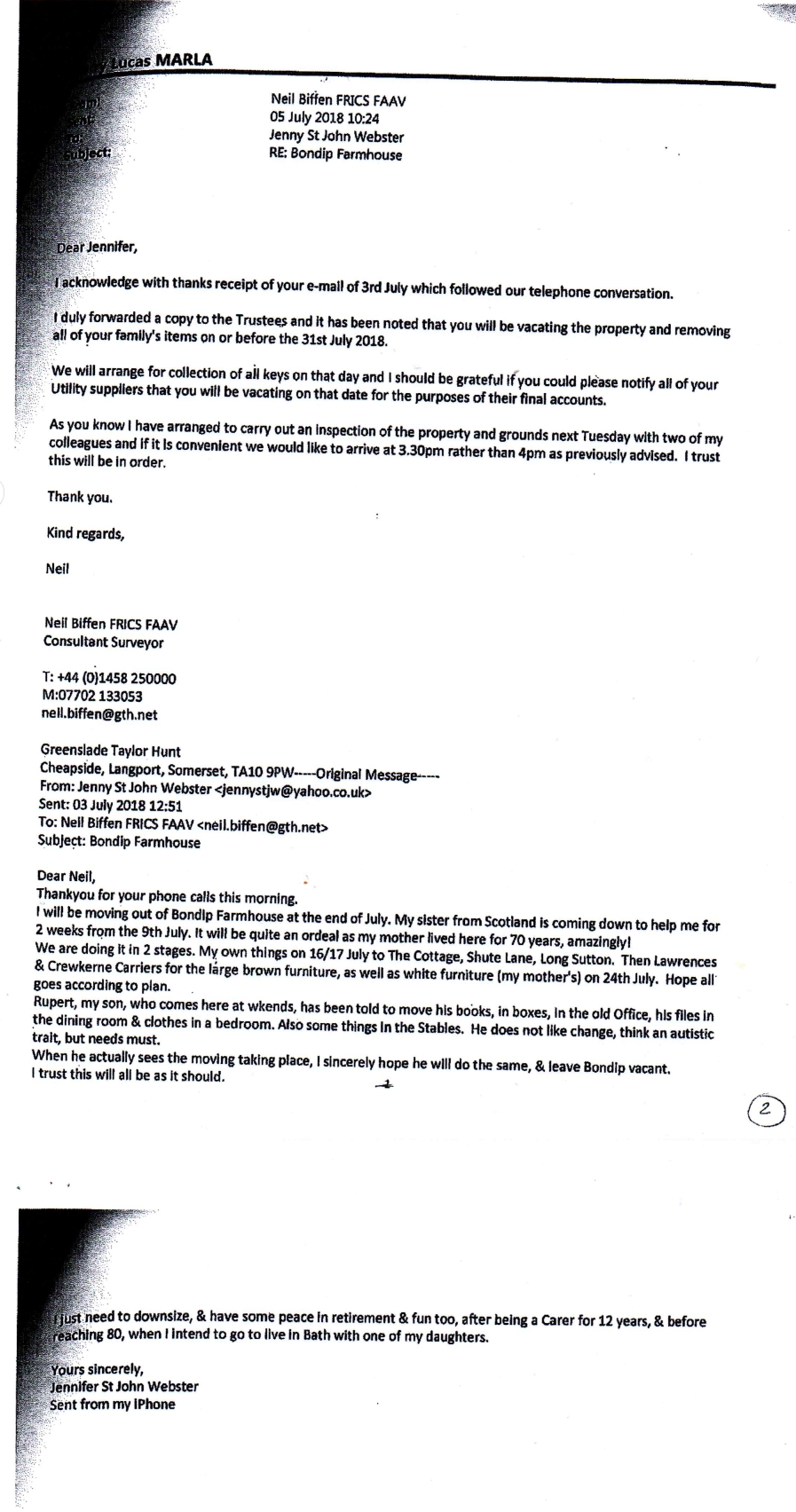

An offer was made for me to buy the house, but I can't raise the money because of (a) a £1/2 million costs liability and (b) the rundown condition of grandmother's house makes it unmortgageable. My grandmother spent all her time working in her garden. Therefore as soon as the 1st claim is dismissed a 2nd possession claim is brought. This time there's an interim application to strike out my defence (materially similar on both occasions). My legal insurers pull the remaining funding shortly before a strike out hearing. Pro bono representation at the last minute raised a point under Rent Acts (and Housing Act) but the judge hasn't listened. A defence was struck out. I was then told that after my mother and I received a notice to quit, and my mother moved out, that means that a long lease held by my grandmother was "surrendered by operation of law" since my mother moved out. If that's true then I think it ought to have been raised at the 1st possession claim in a single trial. Apparently my mother was sent an email by estate agents telling her that everyone had moved out and "we will arrange for collection of all keys".

Another alleged offence

The trouble is that if estate agents take all keys to a house and lock it up, locking out family members (and a family member who by agreement is entitled to an assured agricultural occupancy) that's going to be an alleged offence under section 1 Protection from Eviction Act 1977. My family members are residential occupiers. I was told by the High Court in Bristol that the house was available, named in a notice to quit, and I am the family member by agreement who is entitled to an assured agricultural occupancy under Schedule 3 Housing Act 1988 after my grandmother died. There's no order for possession when the events take place. If estate agents or their employers lock out residential occupiers without an order for possession then they are guilty of an offence under section 1 Protection from Eviction Act 1977. Since when is an offence deemed an operation of law? It sets an impossible precedent. As it's now the second time there's an alleged offence the state is alleged as guilty of harassment under Protection from Harassment Act 1997.

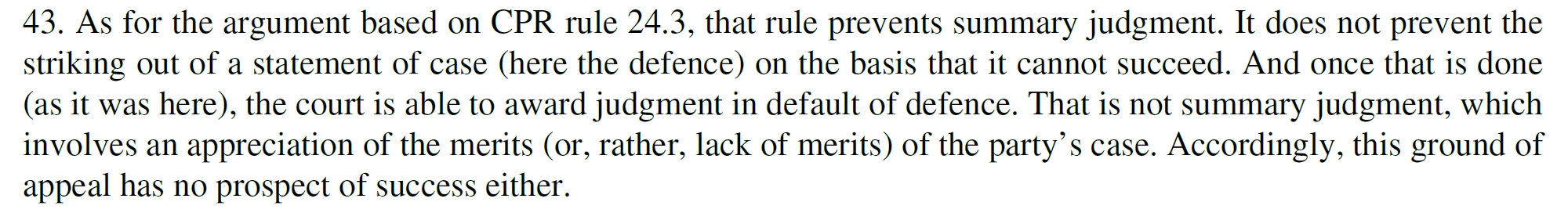

Unlawful decision

Not only that, but 18 months later when a possession order is made against the family it's made by "judgment in default of defence" when under CPR 55 the court doesn't have any power to make a possession order by Part 12 Default Judgment. That's 2 or 3 reasons for an unlawful order. The court's bailiffs were trespassing when they broke down the kitchen doors.

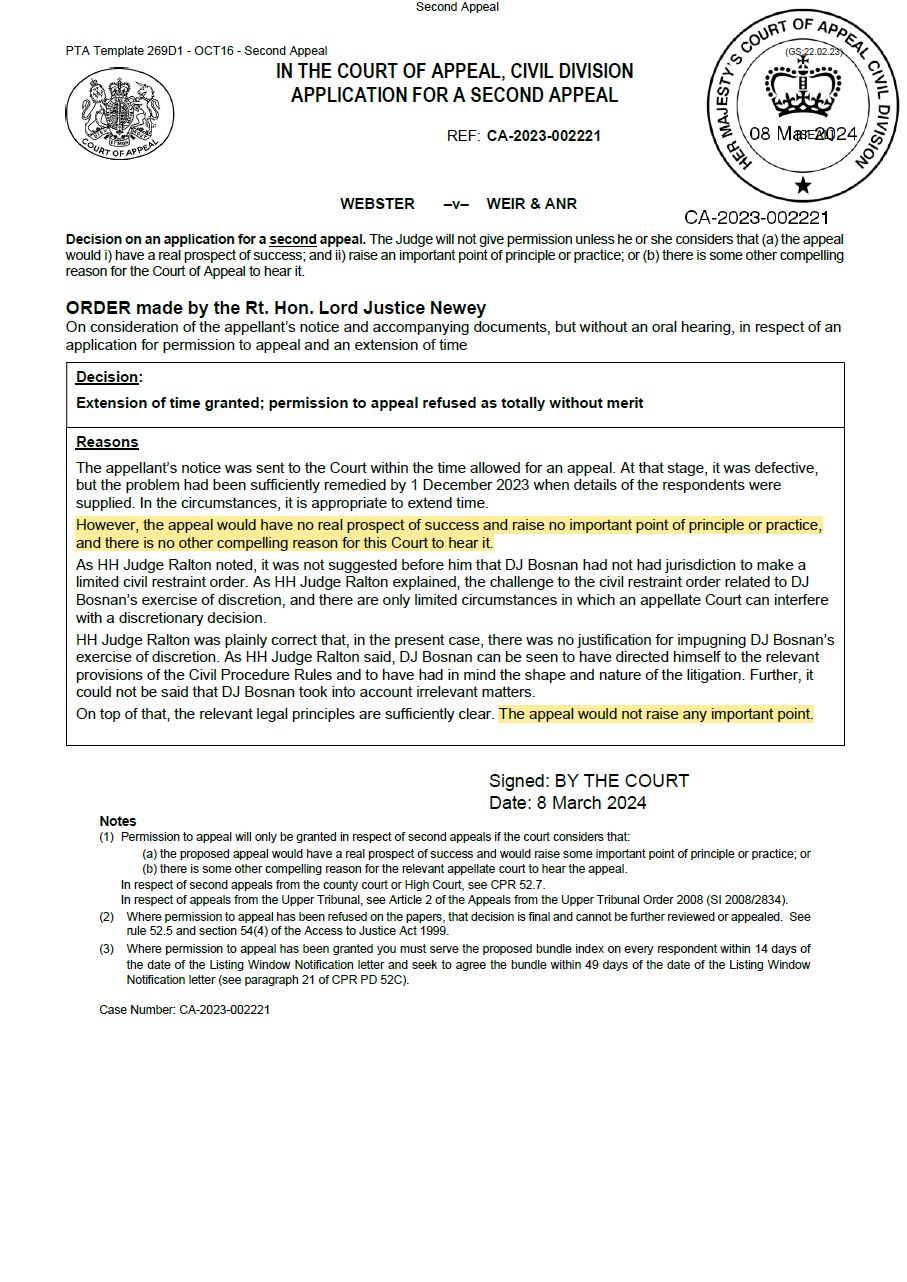

No routes of appeal

The same judge who cancelled my land charges nearly 10 years earlier refused permission to appeal evictions then strikes out a professional negligence claim. The Court of Appeal says that any points raised are unimportant including the unequal enforcement of issue estoppel, protection from eviction, and any complaint under Disability Discrimination Act 1995 or Equality Act 2010. Does that mean that persons with disabilities and their family members are unimportant? It's possible to apply to European Court of Human Rights (to protect rights already there in UK legislation) or the United Nations Committee on the Rights of Persons with Disabilities. The UK has signed the Optional Protocol to allow an application. Since without disability things could not have gone this far here's the start of an application to the United Nations Committee. Meanwhile, please sign the petition for a debate in Parliament.