Disability

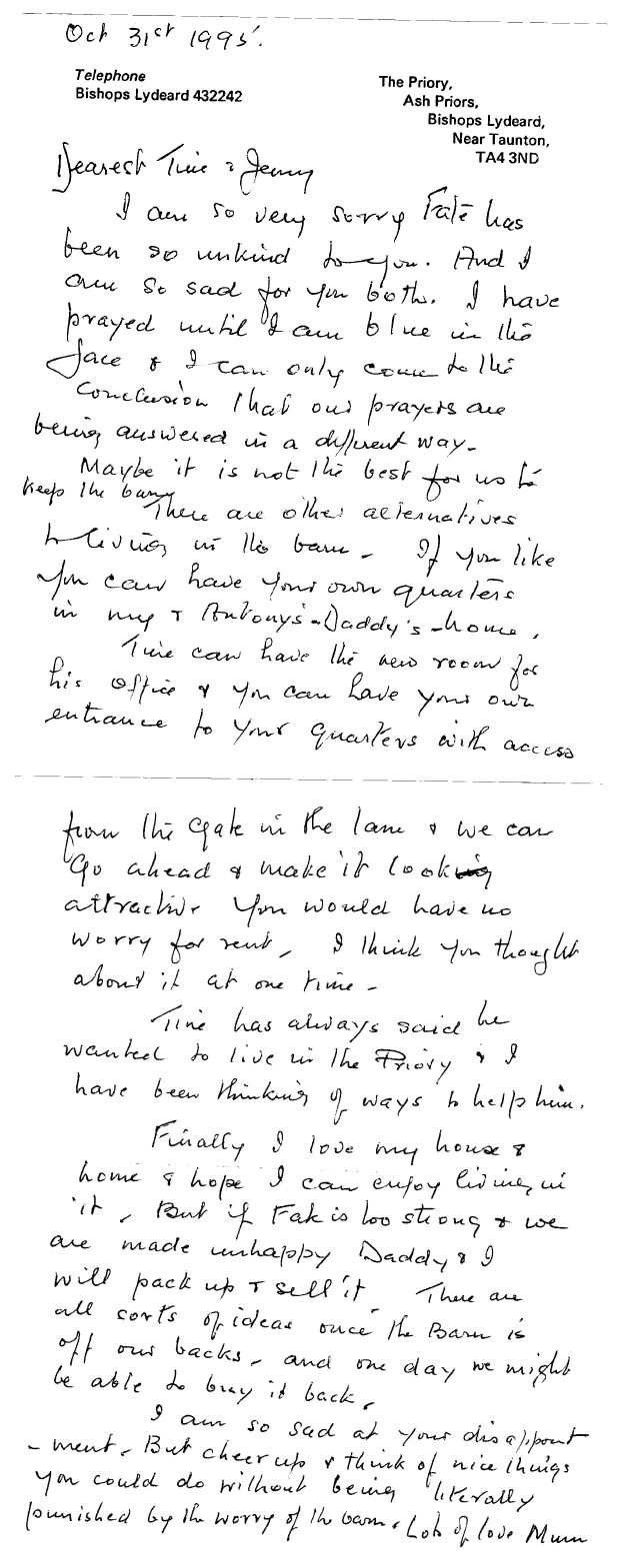

From the introduction the making of disability clauses in a will and taking away representation on a basis of disability then producing tax returns to reduce the family's work to nothing (a kind of disability tax) then family member evictions (without a single trial) I think meets or ought to meet a definition of discrimination on a basis of disability. There ought to be some protection against the treatment under Equality Act. Particularly where nobody tells the person with a disability or their family members what's going on until after the fact.

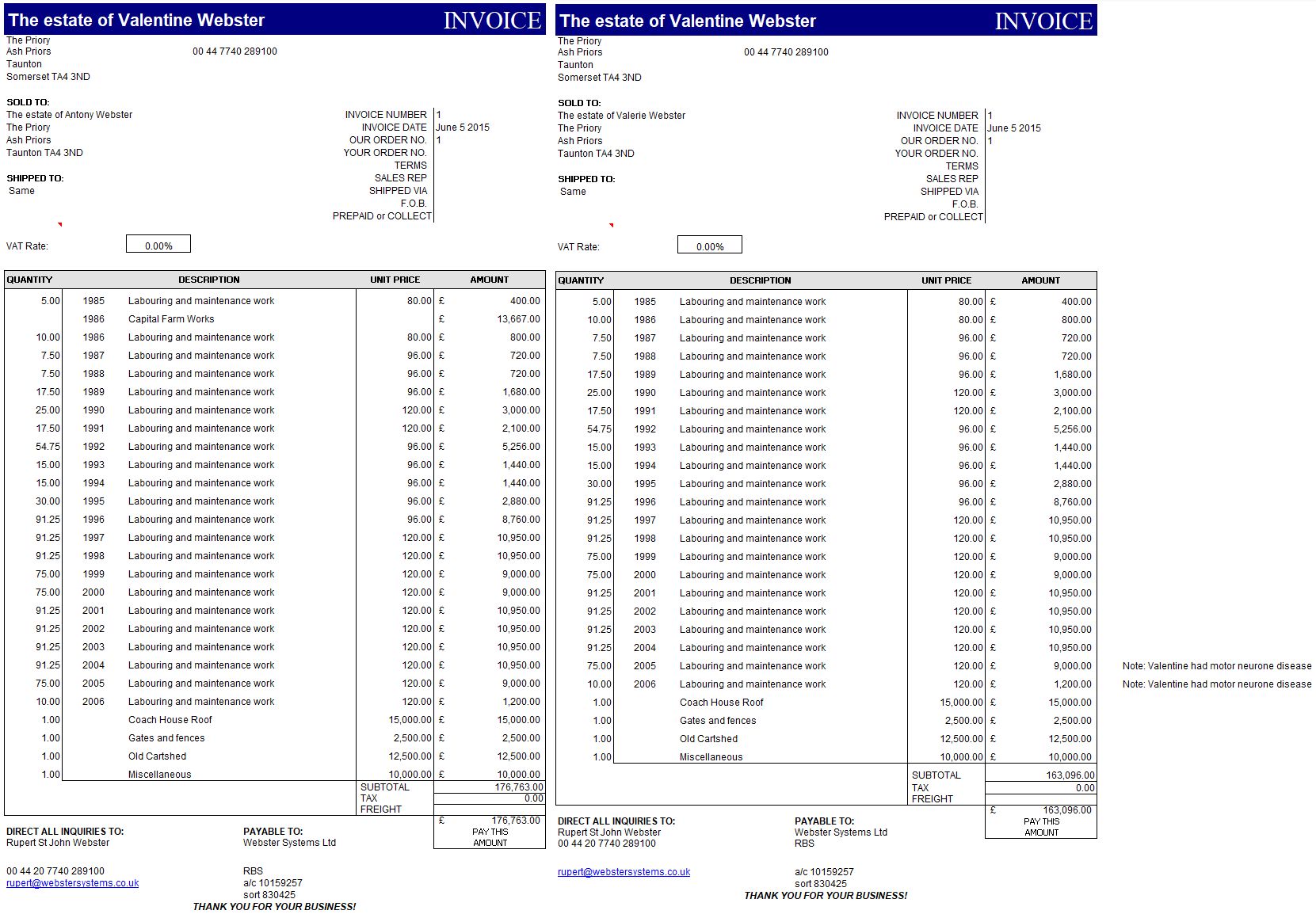

Agricultural work

I'm being told that payment for 20+ years of farm work and investment is covered by hypothetical rent and something called "mutual family support". Used as a term to balance no repayments for works done around the farm against the cost of hypothetical rents. So you get this equation

Works invoices = Hypothetical rents + Mutual family support

Where accommodation isn't in great condition so over the years more money (uninvoiced) is paid to improve it. Tens of thousands of £ more (uninvoiced) paid to fence & maintain Taunton Trees over 20+ years. Making the value of "mutual family support" come to hundreds of thousands of pounds. How is that left out of tax returns and accounts?

Work by others

If anyone else did any work at the farm then they ought to invoice for it. I don't know of any other workers or invoices for farm work. As far as I know everybody else took jobs elsewhere as teachers and business people and that's what they invoiced and were paid for. Other people, including solicitors firms, don't expect to work for nothing.

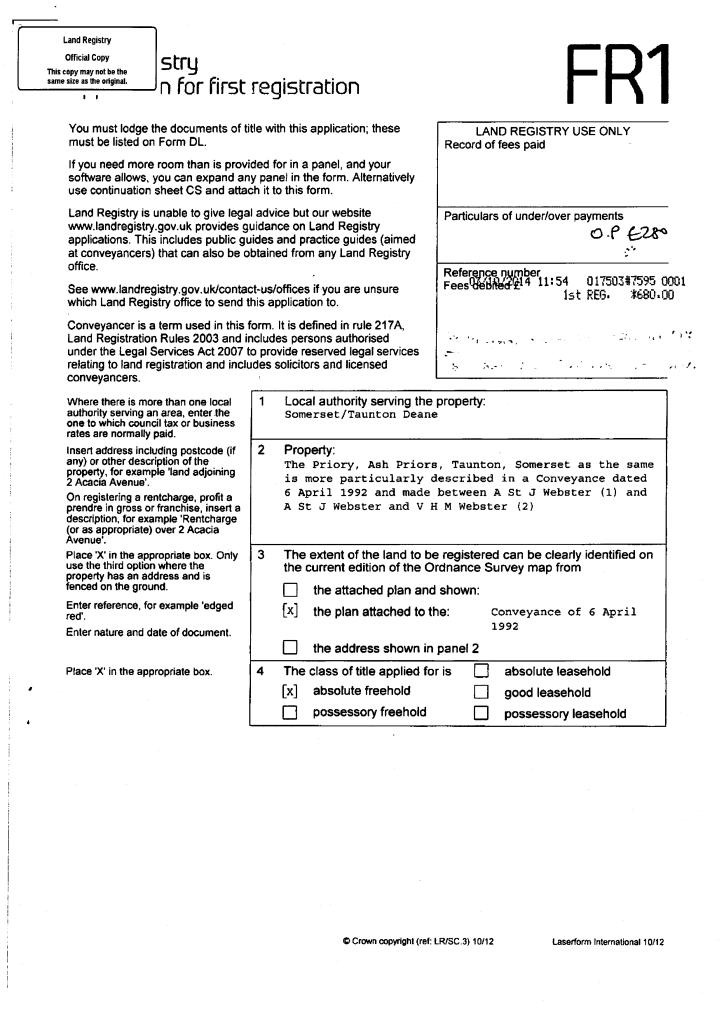

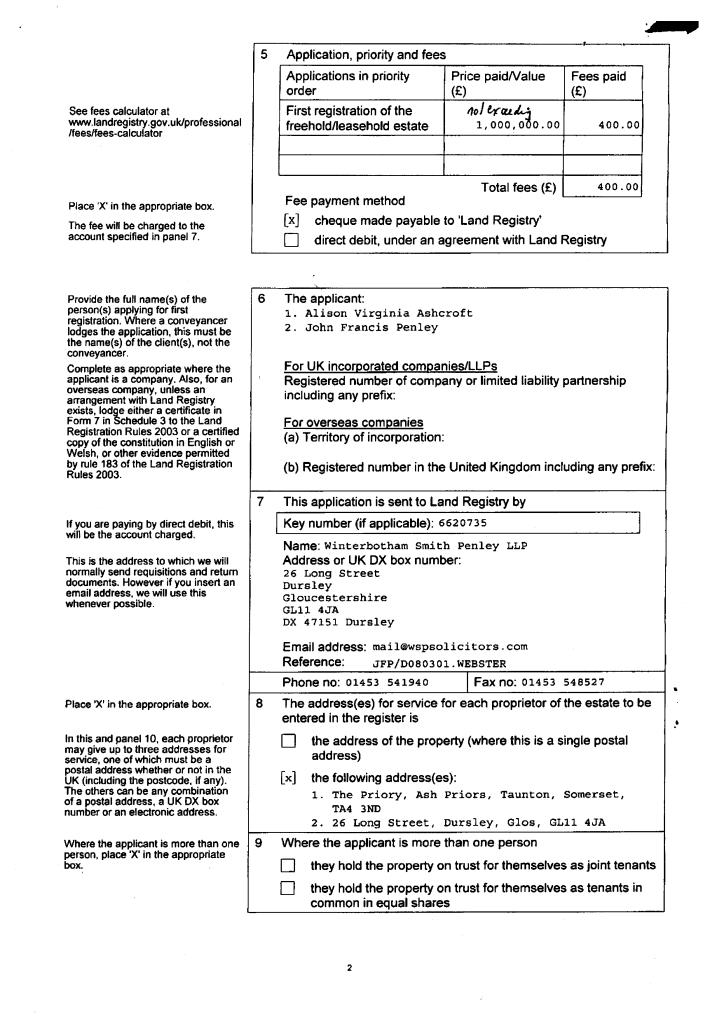

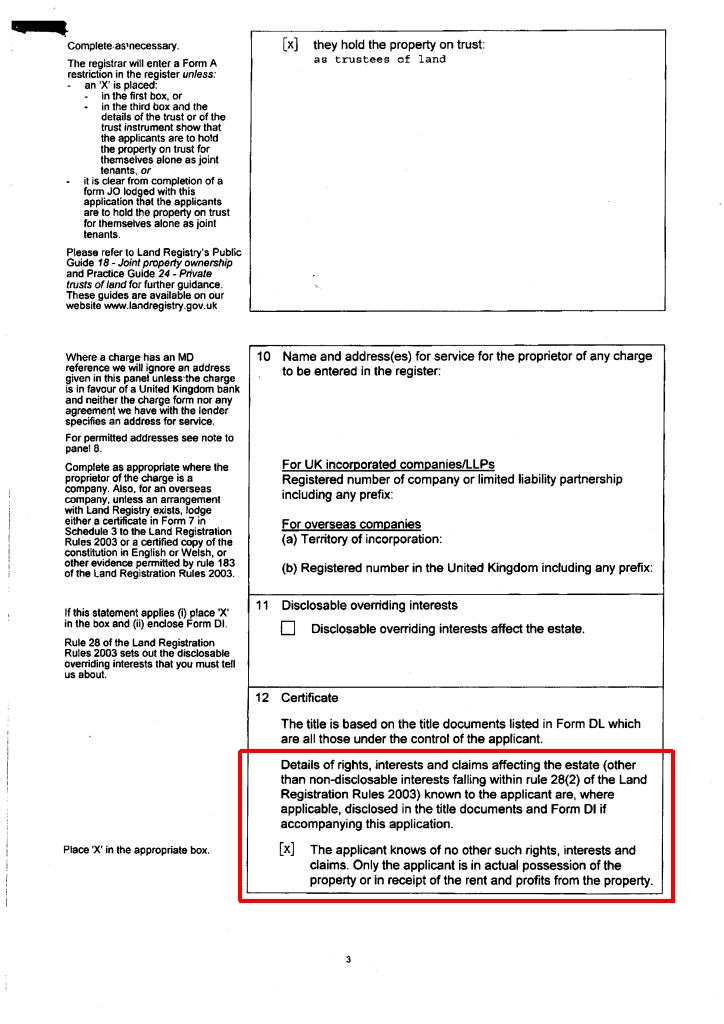

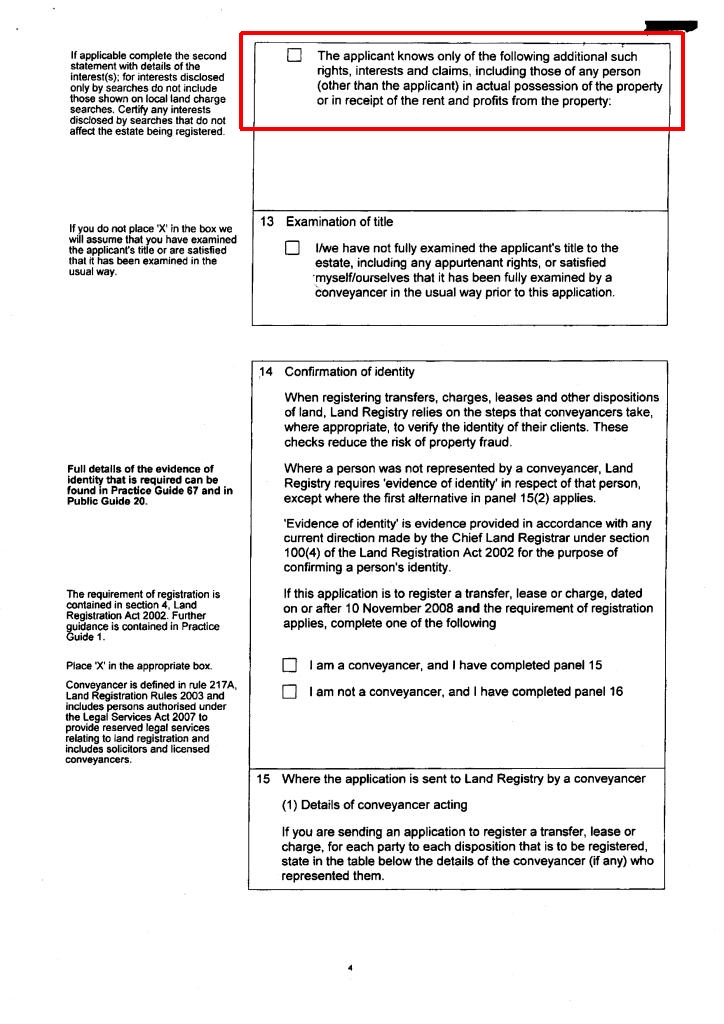

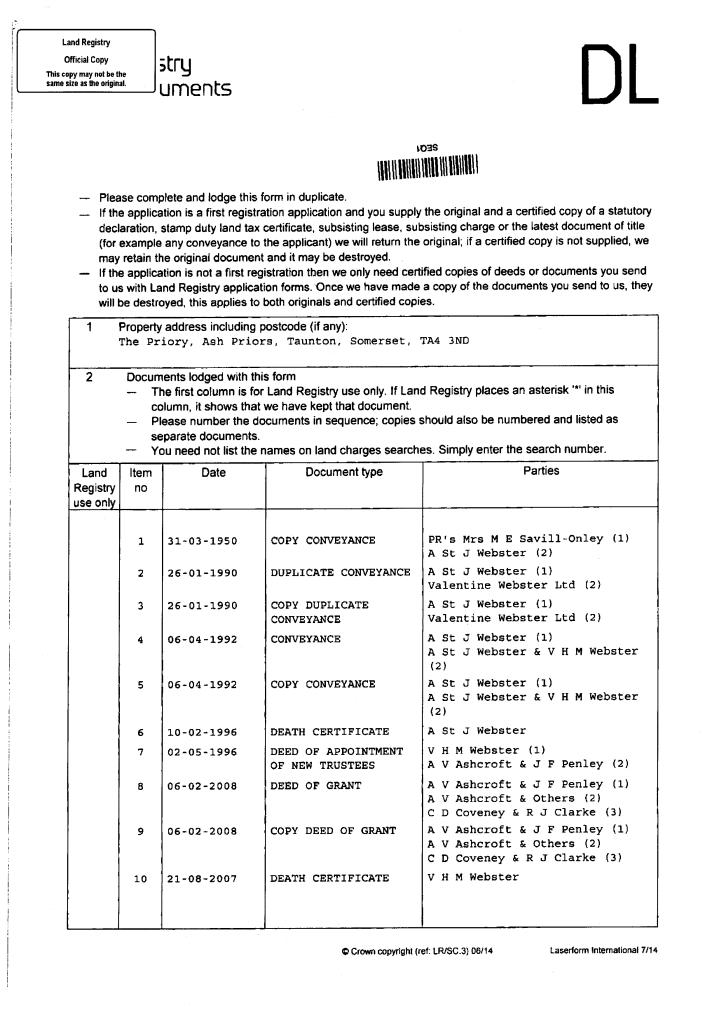

Housing Act, Land Registry and a cloak for fraud

Agricultural workers not only get paid for work but also benefit from Housing Act 1988 assured agricultural occupancies. That's an overriding interest in accounts, tax returns and at Land Registry. Why do these fail to be declared here and again here in the first registration of our farmhouse? It seems to me a cloak for fraud that farm work and accommodation is "mutual family support" followed by unequal enforcement of issue estoppel used to defeat statutory provision, and cause alleged offences under Protection from Eviction. It makes the work look like unlawful slave labour under modern slavery by deception.

Issue estopped possession claims

The evidence shows otherwise but if my grandparents did want to evict their children, grandchildren and great grandchildren from your own quarters and from Taunton Trees then someone needed to bring a claim for possession in a single trial. High Court trial judges and teams of trial barristers & representing solicitors would have known that but nobody brought an application nor was an order made by the court's own motion. The "issue estopped" mantra is then repeated by every judge on any related matter. It's being unequally applied.

Issue estoppel fraud

There's a modus operandi:

- Work out a dispute (probably involves tax)

- Apply for legal action

- Get a decision

- Everything is issue estopped

Issue estopped protection from eviction

The 1 hour story shows how evictions were also carried out in alleged breach of Civil Procedure Rules. Using unequal issue estoppel to overrule the rules to lawfully bring about evictions, and breaking the rules for making possession orders.

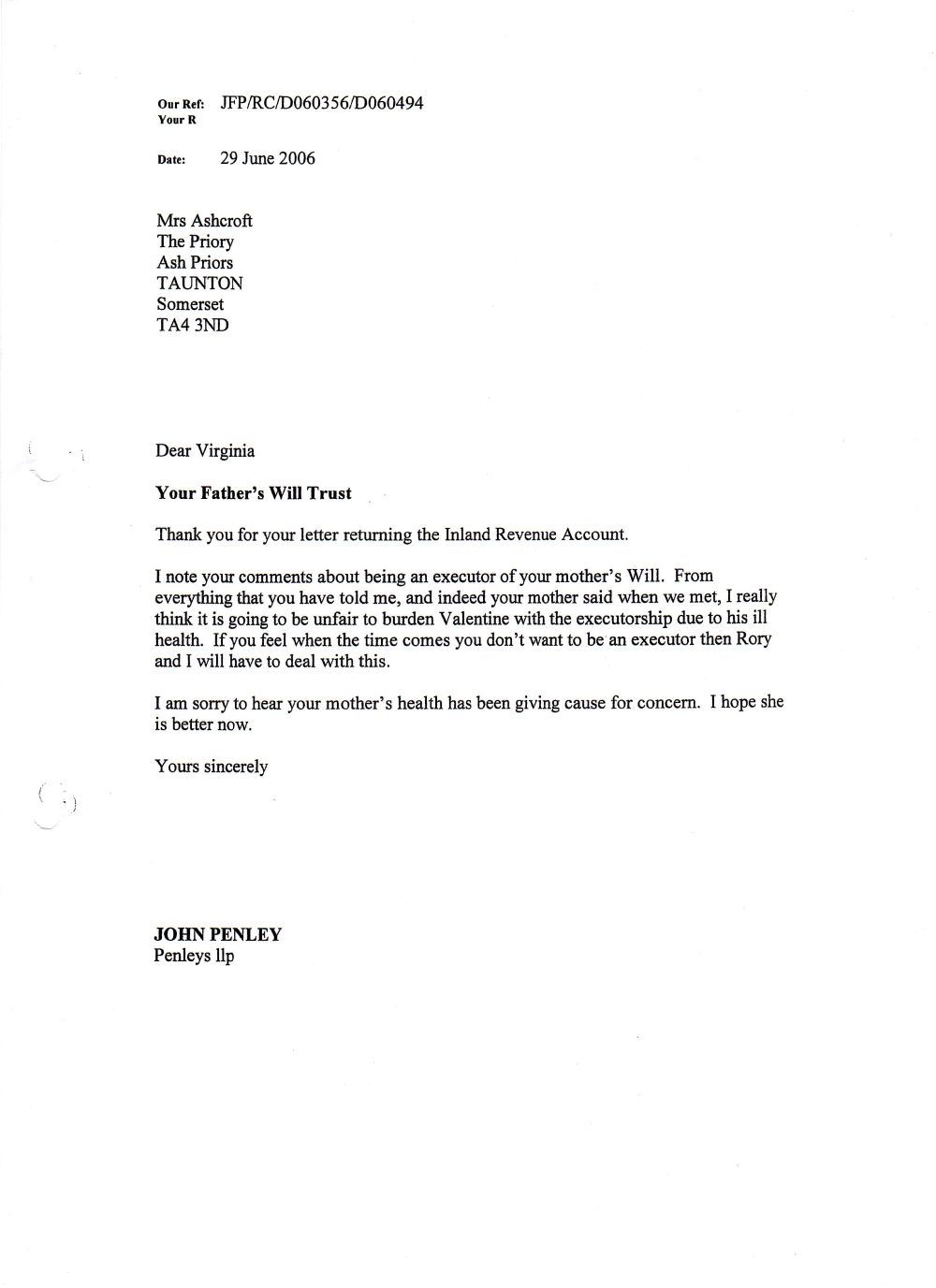

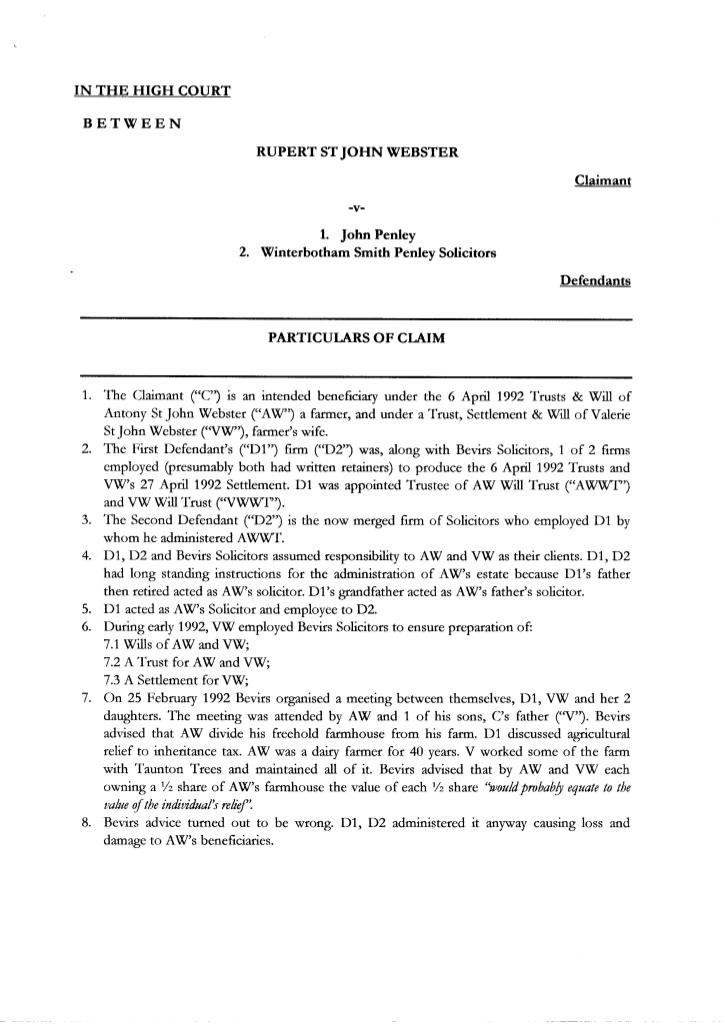

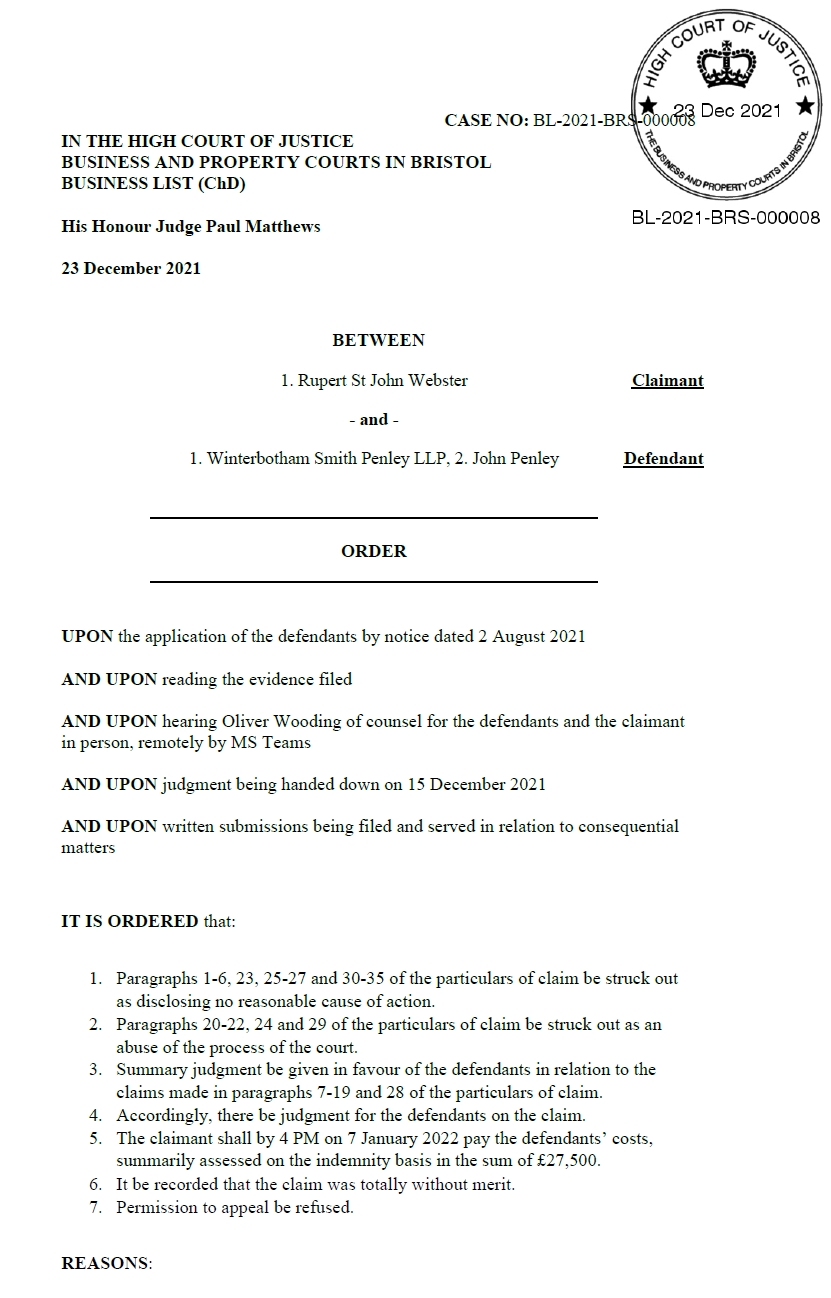

Civil remedy under professional negligence

It took a great deal of work to write out particulars of claim in professional negligence that would've been impossible to plead without disclosure at trial. These were all struck out as unclaimable either because of issue estoppel or because of Limitation. The former is a circular argument. On the latter the legal owner made trusts for 80 years since he died in 1996. By my maths that's until around the year 2076. Don't trustee duties apply the whole time? If you think any of these points are important, please sign the petition for a debate.